The Inflation Reduction Act

A Step in the Right Direction

Passing legislation to fight climate change has been a long and frustrating battle for many politicians, especially in recent years. Now, climate activists are experiencing a rare moment of optimism after the Senate and the House passed the first ever comprehensive climate bill, the Inflation Reduction Act, which is expected to reduce greenhouse gas emissions by about 40% below 2005 levels by 2030. Now sent to Biden’s desk, the bill aims to decrease the cost of prescription drugs and abate inflation by accelerating solar and wind energy generation, speeding electric vehicle adoption and targeting specific socio-economic demographics to mitigate the impact of rising utility rates. According to Data from Progress and Climate Power, this historic investment in clean energy has witnessed remarkable bipartisan support among voters.

Fighting Inflation

The Inflation Reduction Act (IRA) is likely to reduce budget deficits by over $300 billion in the first nine years, although many of these savings will likely take time to fully materialize. The Committee for a Responsible Federal Budget expects that the IRA will very modestly reduce inflationary pressures in the near term while lowering the risk of persistent inflation over time, thus making it easier for the Federal Reserve to reduce inflation without causing a recession.

There are at least three reasons to expect that the bill will reduce inflation substantially. One is that the IRA enacts historic deficit reduction. Another is that regulatory and permitting reforms will be deflationary. According to Senator Joe Manchin, these energy-related regulatory reforms will include “a suite of commonsense permitting reforms this fall that will ensure all energy infrastructure, from transmission to pipelines and export facilities, can be efficiently and responsibly built to deliver energy safely around the country and to our allies.” By increasing energy supply and reducing the prices of energy and oil, these policies should all put downward pressure on inflation.

Lastly, many of the policies in the IRA reduce prices at the microeconomic level, whether by lowering the price of prescription drugs, health care premiums, or renewable energy. In combination with the macroeconomic effects of the bill, these microeconomic effects will likely help to hold down inflation.

Updates to the ITC

A notable provision of the Inflation Reduction Act is the long term extension of the Investment Tax Credit. The bill calls for a ten year extension of a 30% tax credit, meaning that individuals will be able to claim 30% of the total cost of their solar system installation on their federal taxes. This tax credit will decrease to 26% of the cost of the installed equipment in 2033, and in 2034 decrease further to 22%. Furthermore, the tax credit can also be applied to energy storage whether it is co-located or installed as standalone energy storage. It is also important to note that the 30% tax credit will be retroactively applied to anyone who has installed their solar system in 2022.

While previous renewable energy tax incentives were targeted to for-profit companies, included in the Inflation Reduction Act is a direct pay provision for nonprofits and government entities so that they can also benefit from the 30% tax credit.

Supercharging the Clean Energy Industry

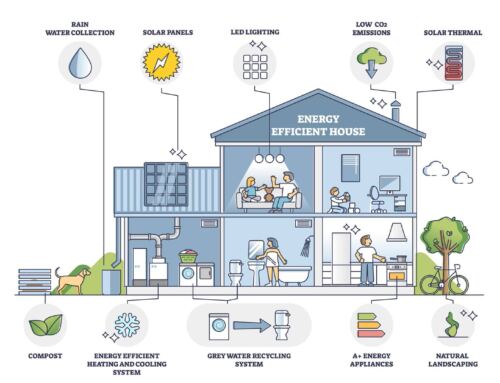

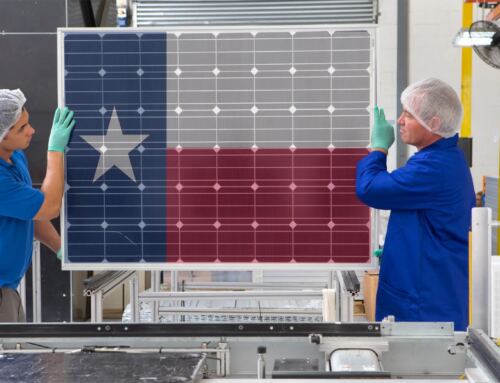

The IRA’s climate measures include billions of dollars to expand wind and solar power production while increasing domestic manufacturing to insulate renewables from external factors and global price volatility. Domestic production also shores up energy security and helps ratepayers know what to expect on their energy bills.

Additionally, the bill will also use tax credits to make electric vehicles less expensive and make $1.5 billion available to oil companies to cut down their greenhouse gas emissions and penalize them for failing to do so. The IRA will also help further develop technologies such as carbon capture and sequestration, hydrogen, and small nuclear reactors that experts say will be needed to get the U.S. to net-zero emissions by 2050.

Analysis commissioned by the BlueGreen Alliance from the Political Economy Research Institute (PERI) at the University of Massachusetts Amherst also found that the climate, energy, and environmental investments in the Inflation Reduction Act will create over 9 million jobs in the next ten years.

There’s Never Been a Better Time to Go Solar

With the increase and extension of the ITC, as well as provisions that now include battery storage, there has never been a better time to go solar. If you would like a quick estimate of how much solar would cost you, click the button below and #TakeYourPowerBack!

I’m not ready to get solar panels yet, but I would like to know 2 things:

1. How much does it cost to have a battery (e.g. a Tesla Powerwall) installed for power backup? We typically use around 40kWh per day (less in spring and fall; a little more in winter and summer).

2. Are the batteries smart enough to let me program them to charge at night (say between 12 and 6 when not much else is using power)?

Hi Mike,

We’ll be in touch to discuss your options.

[…] to the government’s recent passage of the Inflation Reduction Act (IRA), billions of dollars are being invested in the American solar and clean energy industry. A […]

[…] schools and other non-profit entities to embrace clean energy, particularly solar. In passing the Inflation Reduction Act (IRA), Congress stipulated that the 30% federal solar tax credit (ITC) would now also be extended to […]

[…] IRA: A More Profound Investment Than Expected Additionally, in the US, analysts report that the Inflation Reduction Act will have a far more profound effect across industries than expected. A report published by the […]

[…] a solar system is covered by the federal government in the form of tax credits stemming from the Inflation Reduction Act (IRA) passed last year. Local and state credits that reduce installation costs may also be […]

[…] making state officials hesitant to apply for the federal clean energy grants available through the Inflation Reduction Act due to suspicion that the state legislature may bar them from using those funds in the future. […]

[…] solar takes advantage of state renewable energy incentives, such as those available under the 2022 Inflation Reduction Act, to help homeowners, renters, and businesses save money while also supporting solar power in their […]

[…] positive impact deliberate legislation can have on communities nationwide. President Biden’s Inflation Reduction Act (IRA) stands out as a historic initiative that combats climate change while fostering economic […]

[…] the effort to confront the climate crisis, the Inflation Reduction Act stands as a beacon of hope, signaling a transformative shift towards a sustainable future. As we […]

[…] Inflation Reduction Act: A Catalyst for Domestic Production Addressing this gap, the Inflation Reduction Act emerges as a key player in encouraging more domestic production of solar components. The act […]

[…] is the federal solar tax credit. This credit, available thanks to the Biden Administration’s Inflation Reduction Act, is a tax credit that covers 30% of the cost of your completed solar system, whether or not you […]