Celebrating One Year of Progress: The Inflation Reduction Act and the Green Revolution

In the effort to confront the climate crisis, the Inflation Reduction Act stands as a beacon of hope, signaling a transformative shift towards a sustainable future. As we approach its one-year anniversary, we reflect on the momentous strides taken in combating inflation and promoting clean energy adoption. With its innovative policies and financial incentives, the Act has paved the way for a greener economy, reducing greenhouse gas emissions and stimulating investments in clean energy technologies. Let’s consider the Inflation Reduction Act’s journey thus far and its impact on the United States’ transition towards a more sustainable future.

The Inflation Reduction Act – One Year Later

Since its enactment on August 16 2022, the Inflation Reduction Act has turbocharged clean energy technology adoption, taking significant steps towards a greener economy. A staggering $370 billion has been set aside for investments in clean energy solutions in every sector of the economy. In addition, the IRA’s tax credits incentivizing businesses and homeowners to go green were initially estimated by the Congressional Budget Office to cost about $270 billion over a decade. Now, it’s predicted that the tax credits might be taken advantage of far more aggressively and that the federal government could pay out three or four times this amount.

This unprecedented level of investment has bolstered the growth of renewable energy sources such as solar, wind, and hydroelectric power, positioning the United States as a global leader in clean energy adoption. The Act has also spurred research and development in clean technologies, accelerating the pace of innovation in the sector. These impressive achievements have not only reduced inflation but have also set the nation on a path to mitigate the impacts of climate change effectively.

Financial Motivation for Going Green

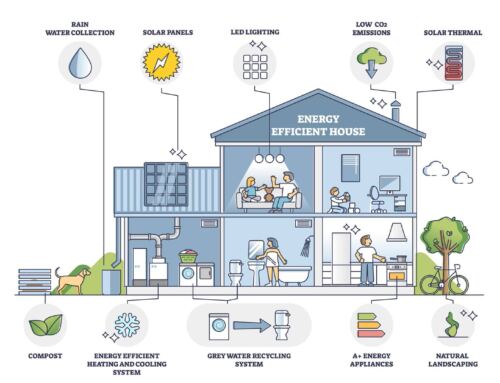

One of the critical aspects of the Inflation Reduction Act is its ability to motivate individuals and businesses financially to embrace sustainable practices. The Act offers a range of incentives, tax breaks, and grants for clean energy adoption and carbon emissions reduction. These measures have encouraged companies to invest in renewable energy projects, which, in turn, have not only reduced their operational costs but have also minimized their carbon footprints. Homeowners, too, have been enticed to make eco-friendly upgrades to their properties through various rebate programs and energy-efficient tax credits. One such tax credit is the Solar Investment Tax Credit (ITC), which allows homeowners and businesses to receive a deduction on their federal taxes equal to 30% of their solar panel installation costs between 2022 and 2032. By making sustainable choices more financially viable, the Act has successfully transformed green practices into a mainstream economic endeavor.

Greenhouse Gas Cuts and Limiting Factors

The Inflation Reduction Act has undoubtedly led to significant cuts in greenhouse gas emissions, marking a substantial step forward in addressing climate change. By focusing on decarbonizing sectors such as transportation and power generation, the Act has managed to mitigate the impact of carbon emissions on the environment. However, there remain some limiting factors that need to be addressed. One major challenge is the build-out of transmission lines to effectively distribute renewable energy from regions with abundant resources to energy-demanding urban centers. Additionally, there is a need for an expansion of electric vehicle charging infrastructure to encourage the widespread adoption of electric vehicles. Despite these challenges, the progress made in emissions reduction is undeniably a significant accomplishment for the nation’s commitment to combating climate change.

The Future of the Inflation Reduction Act

The Inflation Reduction Act holds great promise for the nation’s transition to clean energy. With continued public support, the Act is projected to see even greater investments in clean energy technologies. According to a report by Unrig Our Economy, the inflation rate has declined to its lowest in two years, largely attributed to the positive impacts of the Act on the economy. This encourages policymakers to further promote clean energy investments and incentivize sustainable practices. Additionally, support for the Act remains strong, as demonstrated by Navigator Research, which found that two out of three Americans continue to back the legislation. This widespread support is crucial for the Act’s longevity and its potential to drive the nation towards a greener, more prosperous future.

Take Advantage and Create a Positive Impact by Going Solar

As the Inflation Reduction Act marks its one-year anniversary, we celebrate the significant progress made in combating inflation and driving the green revolution. By motivating individuals and businesses financially to embrace green practices, the Act has successfully transformed sustainability into an economically viable choice. Though challenges remain, the Act’s positive impacts on greenhouse gas reductions and the economy are undeniable. With continued support and further investments, the Inflation Reduction Act will play a pivotal role in curbing emissions and shaping a greener and more prosperous nation for generations to come.

You can help to increase this investment into clean energy by choosing to go solar. With the government covering 30% of the cost of each solar installation, going solar has never been more affordable and accessible for Americans, especially Texans! Take advantage of these tax credits to turn your home or business into a clean energy powerhouse. Not only will you save money, you’ll also become energy independent, meaning you no longer have to rely on the aging Texas grid for power. NATiVE is here to help you on this journey towards energy security. Receive a free quote and learn more about how to go solar in Texas.

#TakeYourPowerBack with NATiVE Solar.

[…] Inflation Reduction Act: Catalyst for Domestic ManufacturingThe Inflation Reduction Act has played a pivotal role in making domestic manufacturing of solar components like Enphase IQ […]