The Solar Investment Tax Credit (ITC)

With tax season quickly approaching, you may be wondering how to claim your solar system tax credits. In this article, we’ll be discussing the federal solar tax credit, also known as the solar Investment Tax Credit (ITC), and how you can take advantage of this incentive to save significantly on the cost of installing a new solar system on your home.

The idea of high upfront costs of installing solar is the predominant reason why homeowners are still hesitant to go solar today, but with modern financing options, tax credits, and incentives, solar is now more affordable than ever. Solar offers its direct users the benefits of cheaper, more stable, and more reliable electricity, and also offers the larger public many benefits. These include increased grid resilience that leads to fewer power outages, localized energy sources that cut down energy transmission costs, and a solution for meeting climate goals stipulated at COP27 in 2022 that aim for the US to achieve net-zero emissions no later than 2050.

The numerous benefits of increasing solar across the country led Biden to help pass the Inflation Reduction Act (IRA) last year, which has since become the largest investment into clean energy in our country’s history. One of the IRA’s most significant effects is reducing residential solar installation costs as a result of an extension and an increase of the ITC. Homeowners can now claim a 30% tax credit for any solar installation completed between 2022 and 2032, meaning that these homeowners will receive a deduction on their federal taxes equal to 30% of their solar panel installation costs.

In addition, as of the start of 2023, homeowners can also claim the 30% credit for stand-alone solar batteries with a minimum of 3 kilowatt-hours (kWh) of capacity. The battery does not have to be directly tied to a solar panel system to qualify.

Who Qualifies for the Federal Solar Tax Credit?

Who Qualifies for the Federal Solar Tax Credit?

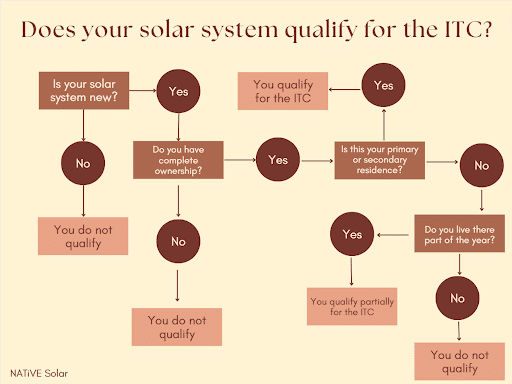

The ITC is available for solar customers throughout the US, though there are certain criteria that must be met to qualify. First off, the solar system installation must be completed within the qualifying time period, that being no later than December 31st 2032. After this date, the ITC is scheduled to decrease by 4% each subsequent year. In addition, the solar system only qualifies for the ITC if it is new or being used for the first time. It’s therefore not possible to qualify for the deduction with a pre-owned system such as one that’s been pre-installed on a newly purchased home.

Another important qualification needed to meet ITC requirements is that the homeowner must have complete ownership of the solar system. Of the four financing choices available (full price purchase, loan, lease, or power purchase agreement), only homeowners who purchase at full price or take out a loan meet this ownership requirement.

Lastly, to qualify for the ITC the property on which the solar system is installed must be either the homeowner’s primary or secondary residence. The residence can, however, be different from a typical house, as residences such as mobile homes, condos, and houseboats still qualify. Rental properties, on the other hand, cannot be claimed for the ITC unless the homeowner lives there for part of the year and rents out the property whenever they aren’t residing there. In this case, they can only claim the credit for the amount of time that they live at the property. For example, if the homeowner lives at the rental property for only half of the year, they will qualify for only 50% of the deduction as opposed to 100%.

What’s Covered?

If a homeowner meets the qualifications for the ITC, they are eligible to claim a federal tax credit that covers 30% of the following:

- Solar panels cost

- Solar equipment costs like inverters, wiring and mounting hardware

- Labor costs for solar panel installation, including fees related to permitting and inspections

- Solar storage devices that are charged by the PV system

- Sales taxes paid for eligible solar installation expenses (only 25 states offer sales tax exemptions for purchasing a solar panel system, and Texas is not one of them)

How to Claim the Solar Tax Credit

Homeowners will need the necessary tax forms to receive the ITC. The Internal Revenue Service provides detailed instructions for completing the tax form on its website. Below is a general overview of the steps to file:

- Use IRS Form 5695 when you file your federal tax returns.

- You will complete Part 1 of the form to calculate your renewable energy tax credit. Keep your receipts for your solar system project and enter the information accurately.

- Enter the amount of your tax deduction on your 1040 form.

As a reminder, the ITC is a tax credit, not a tax refund. The difference is that a tax refund is paid out to the taxpayer, but a tax credit reduces the amount of taxes owed. If your tax liability for the year is less than the ITC, the IRS will carry over any unused amount remaining to the next tax year.

*Note: We cannot provide tax advice, so please discuss your tax credit with your CPA.

Additional Incentives

The ITC isn’t the only incentive available to homeowners. There are additional tax credits, rebates, and incentives at the state, city, and municipality levels. However, availability varies by state. Visit this link to learn more about what other solar incentives are offered in Texas. You can also visit the Database of State Incentives for Renewables and Efficiency (DSIRE) to find more information about solar incentives and credits in your area.

Go Solar with NATiVE

With all the state, local, and federal incentives available to go solar, as well as the variety of financing options, there’s never been a better time to tackle the upfront costs of solar that may have kept you from taking this critical step in the past.

Contact us today to schedule your first consultation and a complimentary quote. We’re here to help every step of the way.

#TakeYourPowerBack

[…] can take the form of tax credits, rebates, or performance-based incentives. Most notable is the Solar Investment Tax Credit (ITC) which allows you to claim a tax credit equal to 30% of the cost of your solar installation on your […]

[…] energy bills across the country. Installing solar is also now cheaper than ever thanks to federal and state tax credits, as well as a range of financing options. You can receive a free quote right […]

[…] the Biden administration’s clean energy incentives, such as the federal solar tax credit, make it even more affordable for individuals and organizations to go solar. This incentive allows […]

[…] available financing options, incentives, and tax credits to make the transition to solar and smart home technologies more […]

[…] the initial expense. One of the primary advantages of ownership is the opportunity to capitalize on federal and state incentives, such as tax credits and rebates, which can significantly reduce the overall […]

[…] that their energy needs are met efficiently and affordably. By leveraging Texas’ solar energy tax credits and incentives, we help our clients maximize their savings while minimizing their environmental […]