The Inflation Reduction Act (IRA) Clean Energy Boost

Lately, good news has been hard to come by. That’s why our team at NATiVE believes it’s crucial to highlight the positive impact deliberate legislation can have on communities nationwide. President Biden’s Inflation Reduction Act (IRA) stands out as a historic initiative that combats climate change while fostering economic growth. As we navigate through difficult times, it’s essential to acknowledge the IRA’s role in creating opportunities for all Americans, particularly those in low-income communities, to thrive in the burgeoning clean energy economy.

Acknowledging Impactful Legislation

The IRA is the most significant legislation to combat climate change in our nation’s history, and one of the largest investments in the American economy in a generation. Already, the IRA’s implementation has unleashed an investment and manufacturing boom in the United States unlike anything seen in decades—especially in disadvantaged communities. The U.S. Department of the Treasury reports that this legislation has already triggered over $115 billion in manufacturing investments for the clean energy sector. What makes this noteworthy is the deliberate focus on historically overlooked communities, as these investments are concentrated in areas with lower income, lower college graduation rates, and lower employment rates.

Low-Income Communities Bonus Credit: A Gateway to Opportunity

The IRA’s commitment to inclusivity is evident in the opening of applications for the Low-Income Communities Bonus Credit. This groundbreaking allocated credit provides up to a 10 or 20% boost to the 30% Investment Tax Credit for qualified solar or wind facilities in low-income communities.

The response has been overwhelming, with 725 applications received on the first day alone, representing approximately 170 MW of capacity. This initiative aims to increase clean energy facilities, encourage new market participants, and uplift individuals and communities facing adverse health, environmental effects, or economic hardships. If you think your solar or wind project may be eligible to claim the Low-Income Communities Bonus Credit, you can find more information and apply here through early 2024.

Targeted Incentives for Energy Communities

The IRA goes beyond rhetoric, offering place-based bonuses for investments in communities that have historically depended on the fossil fuel industry for jobs or been harmed by pollution. One such incentive is a bonus credit of up to 10% for clean energy investments in energy communities.

Broadly speaking, an energy community is a community that has been sited near environmentally harmful industries like coal mining or oil extraction. These energy communities have paid a hefty price as sacrifice zones for extractive industries: over the last century, they have disproportionately borne the brunt of pollution, including toxic coal ash exposure and groundwater contamination. The IRA’s bonus credit for these energy communities reflects their need for additional investments to make up for the cost of resource extraction and assists them in getting the benefits they deserve from investments in a new clean energy economy.

Supporting Strong Labor Standards

To ensure workers benefit from the clean energy boom, the IRA encourages clean energy project developers to meet robust labor standards. Prevailing wage standards and the utilization of qualified apprentices from registered apprenticeship programs are incentivized. By fostering well-paying union jobs and proven pathways into the industry, the IRA has the potential to drive investment that will support more than 1 million jobs in energy and related manufacturing sectors over the next decade.

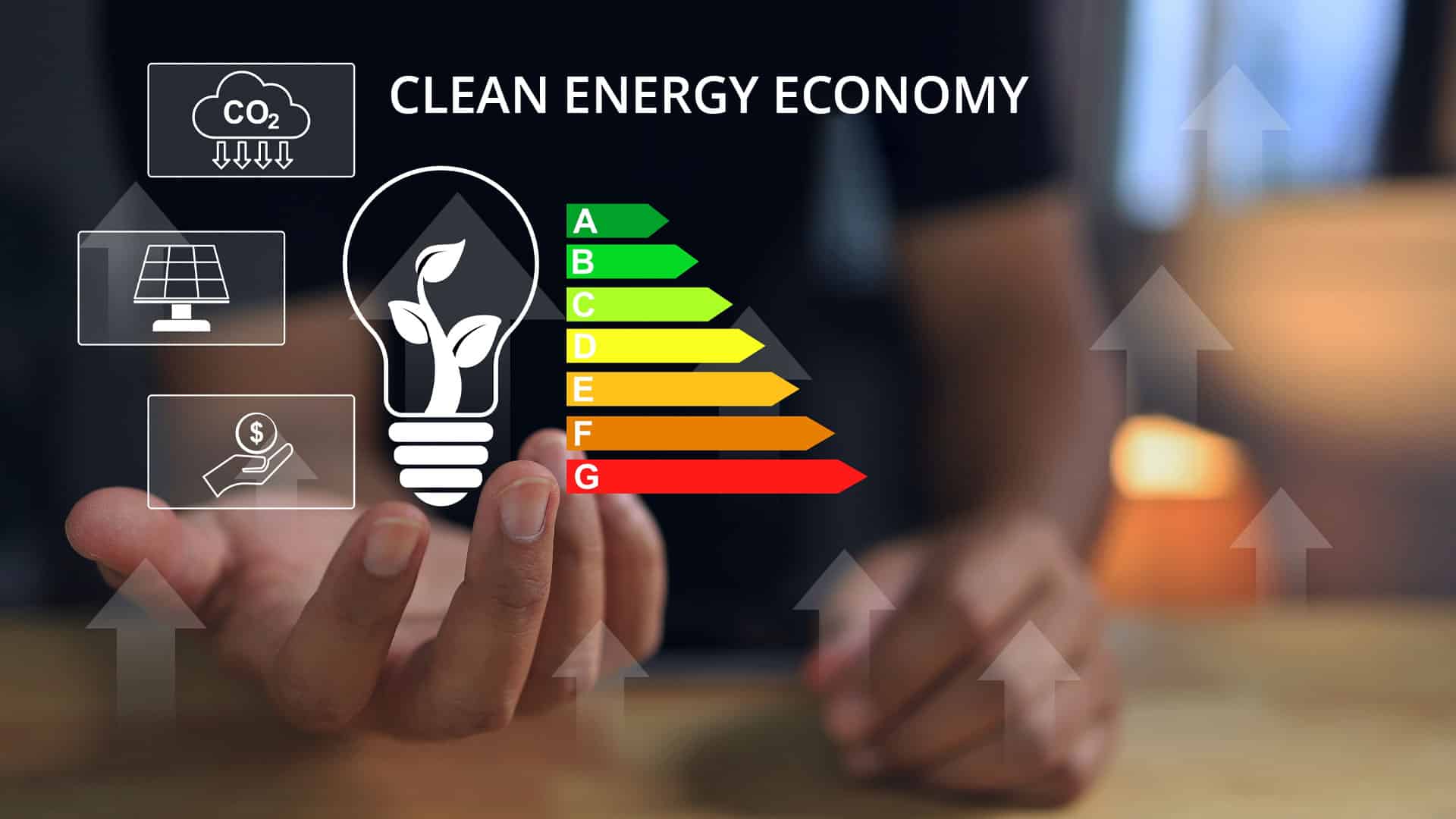

Lowering Costs for Families and Businesses

Household energy costs burden many families and businesses, especially during volatile fossil fuel price spikes. The IRA addresses this by lowering the costs of energy-saving property improvements and rooftop solar installations. Families can save hundreds of dollars annually on energy bills, and small businesses can benefit from programs to enhance energy efficiency. The extension and expansion of tax credits, such as the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit, empower families and businesses to invest in sustainable energy solutions.

Expanding Incentives for Non-Profit Entities

Recognizing the pivotal role played by state, local, and Tribal governments, as well as non-profit organizations and tax-exempt entities, the Inflation Reduction Act allows these actors to receive certain tax credits as direct payments from the Internal Revenue Service. This innovation allows for a more streamlined process, expanding the range of entities with incentives to invest in their communities. From rural electric cooperatives to non-profit organizations, the IRA ensures that these various groups can more easily contribute to the clean energy transition.

Don’t Miss out on These Savings – Go Solar with NATiVE!

The Inflation Reduction Act is a monumental step toward building a clean energy economy that benefits all Americans. Its targeted incentives, support for strong labor standards, energy cost reductions, and inclusive approach to community investments are shaping a future where economic growth and environmental sustainability go hand in hand. As individuals and businesses alike look to embrace clean energy solutions, the IRA stands as a catalyst, ensuring that no one is left behind on the path to a greener, more prosperous future. So, seize the opportunity and claim the benefits – install your solar system with NATiVE and let the Inflation Reduction Act work for you! #TakeYourPowerBack

[…] being eligible for renewable energy incentives, have struggled to access these resources. The Inflation Reduction Act of 2022 has made solar projects on tribal land more economically viable, offering tax subsidies of up to […]