The 2022 Federal Solar Tax Credit

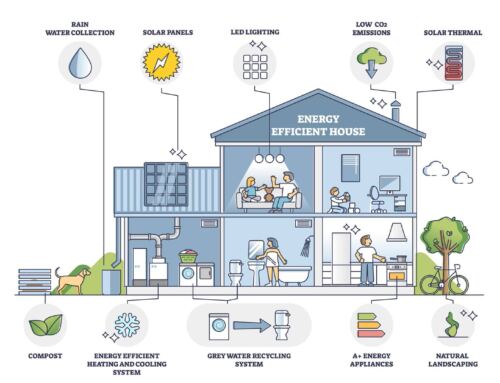

At NATiVE, we strive to educate and support consumers in their transition from a consumer to a “prosumer”. Prosumers take advantage of available tax credits, demand response, and energy efficiency. They seek to minimize consumption through awareness of their carbon footprint. To stimulate this energy transition, the US Government has created a range of incentives to decarbonize, decentralize and democratize our electrical infrastructure. While these incentives can be confusing and lead to many questions, NATiVE has summarized important points to consider before being overwhelmed by both valid and misleading information.

Since 2005, the federal government has incentivized homeowners to install solar through the solar investment tax credit (ITC). This program allows homeowners in certain tax brackets additional incentives for an ownership model. The shift from leasing to finance models for solar is a recent development that has allowed homeowners to directly benefit from government incentives; but the clock is ticking.

SOLAR ITC – 2022

Currently, this tax credit lets you claim 26% of the total cost of your solar system installation on your federal taxes. Unfortunately, this incentive will decrease to 22% for systems installed in 2023, and unless Congress decides to extend the ITC, the credits will come to an end in 2024.

Historically, the federal tax incentive has been a key driver of increasing residential solar capacity, so an extension of the ITC by Congress is a critical measure to ensure residential solar’s continued growth. However, as of right now, these federal government incentives are decreasing, so if you’ve been considering going solar, now is the time to act!

THE DETAILS

You are eligible to receive the federal solar tax credit if:

- You are a homeowner in the U.S.

- The solar PV system was installed between January 1st, 2006 and December 31st, 2023, and

- The solar system is located at your primary or secondary residence.

The solar PV system must also be owned (not leased) by the homeowner, and the credit can only be claimed on the “original installation” of the solar equipment, meaning the PV system must be new or being used for the first time.

In addition, to claim the tax credit, the solar system must be installed (glass on roof or property) during the tax year. For example, to claim the 26% credit, the system must be in service by the end of 2022. There is no bright-line test from the IRS on what constitutes “placed in service,” but the IRS has equated it with completed installation.

Given that this is a residential solar tax credit, the incentive does not apply to companies and a majority of the energy produced must go to residential purposes. If you have a home office or if your business is located in the same building, at least 80% of the solar PV system cost must be a residential expense to claim the credit.

To receive the credit, you must claim the solar tax incentive as part of your annual federal tax return with the Internal Revenue Service (IRS). Claiming the credit will reduce what you owe in taxes for that year. This tax credit will roll over for up to five years if the taxes you owe are less than the credit you earn.

POLICY INEQUITIES

While the federal solar tax credit has encouraged the adoption of residential solar by making installations less expensive, there are some notable disparities that are exacerbated by the inequitable design of these existing credits. Although President Biden has made clear that bringing clean energy benefits to marginalized and low-income communities is a priority, rooftop solar has disproportionately benefited high-income and white residents. This stems from the federal tax credits themselves, which are currently designed in such a way that high- and middle-income residents receive greater benefits than low-income households.

The ITC provides minimal advantage for those with little to no federal income tax—and thus have little use for a federal income tax break. One way to alleviate these disparities would be for Congress to modify the ITC from a tax break to direct pay in order to help bring clean energy to more Americans. Specifically, this change would allow substantially more homeowners to use the tax credit as well as enable clean energy sources to alleviate the increased energy burden that low- and middle-income communities face. Additionally, this change could help bring solar jobs to lower-income communities.

TAKE ACTION AND CLAIM YOUR CREDIT

While more equitable policy changes are critical, the first step is for Congress to agree to renew the ITC in the first place. Currently, the future of the ITC is uncertain, and therefore it would be wise for homeowners considering going solar to act quickly. There is still time this year to complete your home installation and claim the 26% tax credit. Receive a free solar quote today and Take Your Power Back!

Leave A Comment