Why Go with a Solar Loan?

by David Henry | NATiVE Solar Consultant

Why do people go solar with loans? They realize they will either lose money every month essentially renting power forever, or go solar and rent to own their power.

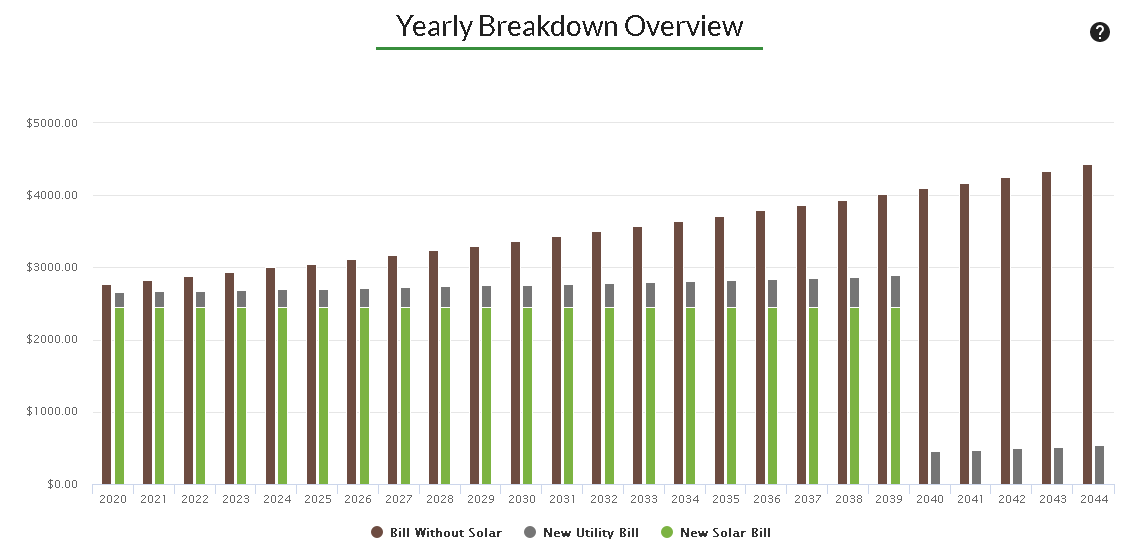

Let’s see a real example from a recent home we did:

In this case, the homeowner’s loan payment plus any small residual payment to the power company (some markets have unavoidable fees) is represented by the green + grey bars while not going solar and renting power forever is represented by the brown bar. Assuming just a small, 1-2% inflation you can visually see some interesting points:

- In the first year this homeowner spent less by going solar plus a small fee to the energy company than not going solar. This is called cash flow positive.

- As time goes on, the loan is free from the burden of inflation and the monthly and added up yearly savings start to take off.

- Eventually the loan is done and the gap between not going solar and solar is in the thousands each year.

By going solar on a loan, this person is already saving money right away. Instant ROI.

Why is it smarter for anyone of any income to use loans to go solar?

With cash, you’d be locked into the investment for, depending on the market, 4-10+ years before you see returns. That’s okay, it’s still something you’ll pay for (energy) anyways, and the panels would be overall cheaper, but why not invest the cash into a market AND convert your existing monthly payment for power to a payment to own a power station on your roof?

Watch the Solar Chats video below and listen to me and Meghan discuss how a loan can actually save you money.

Leave A Comment