*The following is an update (Part 2) written by NATiVE Solar Customer Jim Trudeau

after going solar in March 2014. Be sure to read Part 1 first.

Solar Return on Investment (Part 2)

JANUARY 31, 2015 UPDATE We’ve been through summer and winter, a new spring is coming. We haven’t quite finished a year with the system, but between now and then,

we will spend no money on electricity.

So I can tell you what we saved for real in our first year. There is one complication. We did two things – cut our electric use (mostly the pool pump in Aug of ’13), AND started generating our own power as of March ’14. So…

The actual amount I spent in the year before the system went live, $1910. My bill for the year after that, $6. I spent $1900 less this year. That’s much better than my conservative $1500 rule of thumb I came up with a year ago. HOWEVER…

Some of that saving is from reduced usage, not solar generation. The saving I can assign to solar generation is $1330 for the year. That is slightly below my $1500 guess a year back, but that’s because… I’m using less power than expected. So I’m not saving quite as much as anticipated. Oh darn. 🙂

Another way to look at this, if I used up all of my generated power, I’d save $1500/year. So, my initial figuring and rule of thumb was in fact, SPOT ON! Happy number geek.

Bottom line, in this new regime, I use about $1300-1350 worth of electricity and it costs me nothing. If/when we buy an electric car, my “savings” will increase.

The last little bit of financial analysis: I don’t have to come up with 34K up front. The City’s portion is applied for by the installer, and they get the check directly. For me, I am out of pocket $18,915.42. When I get my tax refund I’ll get about $5,700 back.

I do have to have 20K of capital to make this investment. There are financing possibilities, which would complicate the ROI calculations. We opted to avoid the complications and the paperwork. We’re paying cash. I’m lucky enough to be able to do so, but there are choices that would make your out of pocket lower, but your payback time longer. Your net ROI would be lower.

With no other considerations in mind, this is a reasonable investment, a VERY reasonable investment.

BUT WAIT! It comes in pints!

A major home improvement upgrade has impact on the value of the house. How much? Ah grasshopper, we start to go off into the speculative ethers. Nonetheless, there is data.

The best I could find is a detailed study by the Appraisal Institute in cooperation with the Colorado Energy Office, in the Denver CO area. Sales through 2013. They studied 30 sales, with good detailed data on 22 of them. Here’s the conclusions.

“The case studies, as well as general market data, support the conclusions that PV systems (that are owned) typically increase market value and almost always decrease marketing time.” “22 of 30 case studies indicated PV systems contributed $1,400 to $2,600 per kW to market value.”

Appraisal Institute Solar Impact on Home Values

Appraisal Institute Solar Energy Systems Boost Home Values

Do the math, a 10.4 Kw system, let’s use $2,000/Kw as middle of the road…

I have added $20,000 to the value of my house doing this.

Ah, but a single study? There is another, less applicable IMHO because it is based on the California real estate market, and 2-10 year old data.

Ah, but a single study? There is another, less applicable IMHO because it is based on the California real estate market, and 2-10 year old data.

National Bureau of Economic Research | Sample of homes in San Diego and Sacramento CA – Sales from 2003-2011, and the source document is behind a proprietary wall, but Forbes reported it: How Much Do Solar Panels Boost Home Sale Prices?

Bottom line they were reporting a $4-5 PER WATT premium. That would calculate out conservatively to a $40,000 increase in the sale value of my house. Interesting, but could be affected by inflated CA home values.

Taking another approach… if you reduce utility bills, what impact does that have? It turns out there is very good data for this, huge samples of 40-60,000 sales nationwide, during the 1990s. Comparing essentially identical houses, but one is more energy efficient so has lower utility bills. Perhaps they replaced windows, for example.The ratio in this study ranged from an 18:1 to 23:1 return. Meaning if you reduce your utility bill by $1, the value of your house goes up $18-23. Let’s use our

conservative $1500/year reduction in the electric bill. That figures to a value of $30,000.

So I can’t tell you for sure, but…

The value of my home just went up by (at least?) $20K.

And what did this system cost me? $13K.

I can’t live off the value of my home, but this is a real increase in the value of a key asset.

So..

- I have the capital to make a 20K investment

- I get a 9% return every year, conservative estimate in the form of reduced electric bills.

- I increase the value of my home by more than the cost to me

- I reduce my monthly out of pocket by making this investment (a little side benefit)

Did I say “no brainer” above?

I would be an absolute fool to NOT do this.

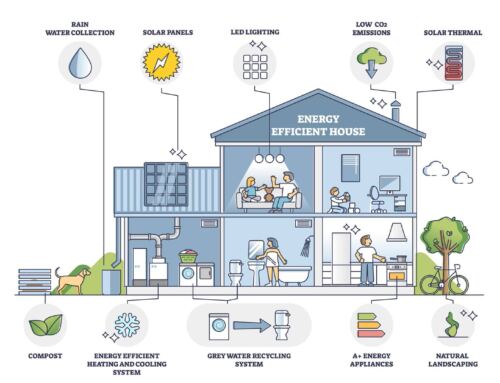

On top of the financial rewards, there is an ecological impact. That’s a separate story.

***UPDATE June 29, 2019***

Native installed our system, which went live March 18, 2014.

Bills NOT paid in that time

- 2014: $1,132

- 2015: $1,261

- 2016: $1,194

- 2017: $1,170

- 2018: $1,187

- 2019: $601 so far

Total Saved: $6,545

Total bills paid in that time: $0

We are on track for a 10 year ROI, not counting the increased value of the house.

If you add that into the mix, the system paid for itself on day one.

Interesting. Although I am curious, you say your electric bill is $0. So does that mean solar system is providing ALL of your electricity, especially during the hot summer months when the A/C is running full blast? How are you managing to do that?

The reason I ask is because I have a 24 panel solar system that provides all of my electricity 8 months out of 12 (100% during the “cooler” months, but partially during the “hot” summer months).

Hi Don! Thanks for reading 🙂 What I mean is the net bill over time. Austin Energy buys all the power, and pays me for it in the form of a credit. Then they charge me for everything I use. In the summer, I do have a bill. It might be $20-$40 more than what they paid for the solar I generate. However I have a credit built up in the months when I produce more than I use. The credit accumulates month to month. Come summer, the credit pays the bill, and it actually costs me $0 out of pocket. The very first year the system was in operation, it started in April 2014 and I did not get quite enough credit to cover the summer. My September actual out-of-pocket that year was $6. Those are the last pennies I have spent on electricity.