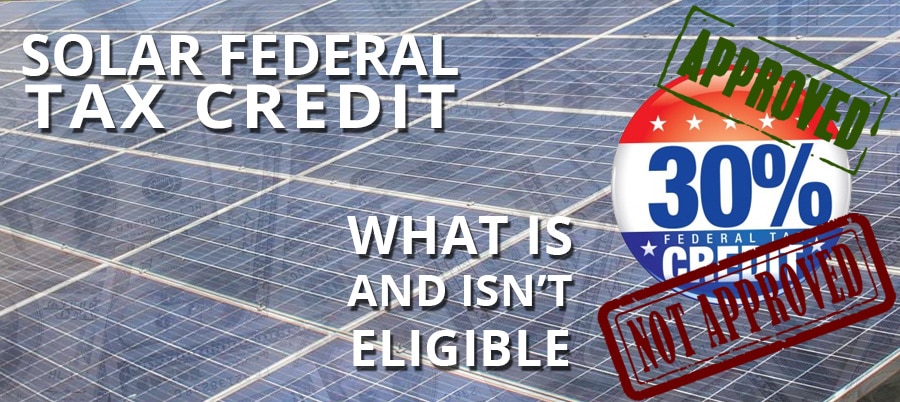

Throughout the years we’ve seen a lot of suspect practices in the solar industry. One that irks us a lot is bundling. The Federal renewable energy tax credit is a great incentive for going solar, but it is unjust to abuse it. Whether it’s tacking efficiency measures or the cost of re-roofing onto a solar project, there are many items to be aware of that don’t qualify. Not only is this practice irresponsible and dishonest by the installer, but it also puts the customer in a potentially bad tax situation.

We are not tax experts and cannot offer tax advice. However, we have know tax industry experts specializing in energy and tax issues, and have asked them to clarify what is and isn’t eligible for the 30% Federal tax credit. If you’re solar curious or have gotten a recent quote with some shady bundling, we advise you to continue reading below!

What is eligible?

One of the most important points to emphasize under both code sections, the solar system must be owned (transfer of title) and placed in-service in the year in which the Federal investment tax credit is claimed.

Additionally, eligible costs that qualify for the Federal investment tax credit include the equipment directly related to the system such as the solar panels, racking, inverters, wiring and monitors. The eligible cost can also include any direct site preparation such as small repairs to the roof surface or a tree removal for sun optimization. Further, it is important to note that current system owners can expand their current systems installed in prior years. This includes strong support recently by the IRS confirming that energy storage systems or power wall units supplied by the solar generated electricity can be qualified as eligible costs. (PLR 201809003).

What is not eligible?

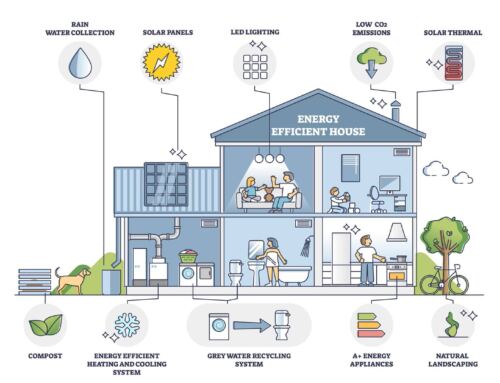

Equally as important is for consumers to understand that there are costs incurred on a residential dwelling or a commercial building that may be ineligible costs for the solar rebate program or the investment tax credits. For example, if a homeowner includes new insulation to the dwelling or adds LED lighting to the interior and exterior to efficiently use the electricity generated by the solar system, these items are not eligible for the Federal investment tax credit. Prior to 2018, these costs may have been eligible for another incentive for a one-time tax credit of up to $500.00 for Residential Energy Efficiency, however there has been no guidance as of this writing from the U.S. Congress on whether the Residential Energy Efficiency tax credit will be extended beyond its expiration date of 12/31/2017.

Item

Solar panel system

Home battery system

Standalone thermostats

Insulation

Lighting (interior or exterior)

HVAC upgrade

Future removal of panels to allow a homeowner to re-shingle

Crawl space sealing

Standalone chargers

Residential re-roof with solar

Commercial reroof with solar

Eligibility for the Federal Tax Credit

Yes! Including panels, racking, inverters, monitoring, and balance of system equipment required to produce electricity from solar panels.

Yes, if connected to a solar system.

Nope.

No way!

No.

Negative.

No Sir and No Ma’am.

Really? Of course not.

Most likely not. It would be VERY rare that a solar array would ever cover greater than 50% of a residential roof, and this appears to be the minimum requirement to allow an owner to include a portion of the reroof cost in the solar cost.

Maybe. It is best to discuss the details for the re-roofing for the commercial building with your tax advisor. There may be some costs that are indeed qualified for the investment tax credit, and there may be some non-ITC qualified costs that can still be immediately expensed by the commercial building owner.

Before consumers enter into a contract for a solar system installation, they should have a detailed listing of all the equipment that will be installed to clearly determine what is eligible for the Federal investment tax credit and also determine the requirements for any local solar rebate program. If you feel the need, please consult your tax advisor or contact us for assistance specific to your system. As it is clear from the early activity in the market that because the incentives matter, it may be worth the discussion on the front end of the project versus at tax return time or rebate filing time when it may be too late to qualify for these incentives.

Leave A Comment