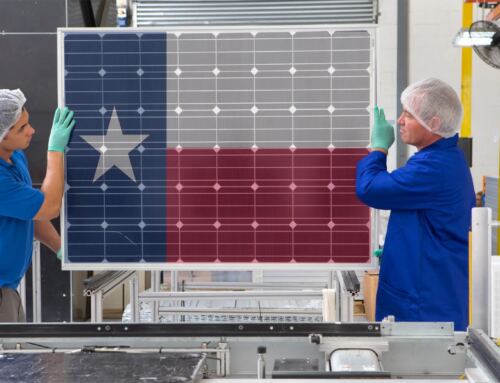

The decline of U.S. solar manufacturing in the past few years has all but scuttled dreams of a new Solar Valley that could create good domestic jobs and bring the same kind of innovation to the cleantech sector that Silicon Valley brought to the computer industry. Could it be the end of the line for the U.S. as a contender in the global renewables race? Probably not, if we shape up soon.

U.S. Manufacturing Woes

It seems that just a few short years ago, solar cell manufacturing companies and startups were all the rage. Investors, the government included, fought hands over head to put money into promising young firms cropping up all across the nation. Sadly today, after years of devastating competition with state-backed Chinese firms and a number of high profile busts, the manufacturing sector of the green economy looks a little beatup. The new year has brought little relief. In early 2013, MiaSole, a promising Silicon Valley startup, was acquired by a privately owned Chinese holdings company, Hanergy Holdings, Ltd for a measly 30 million. What they got was several promising patents on solar technology that was developed with hundreds of million of dollars worth of investment and venture capital funds.

But the fallout is happening all over the world as manufacturers struggle to cope with the glut of overproduction brought on by China’s overzealous drive to dominate the solar manufacturing market. In fact, reports indicate that as much as 70 percent of the world’s solar manufacturers will give up the ghost by the end of 2013. In fact, China saw a steep drop as 42 percent of her manufactures also shuttered their doors despite incredibly generous state backing. But in this game of attrition, China has the upper-hand. China knows it just needs to dial up the subsidies for only a little while longer until American producers give up or go bankrupt. Once it knocks out foreign producers, Chinese solar manufacturers will dominate global production and can increase their prices.

Silver Lining for Consumers and the Solar Industry

Despite all the doom and gloom, this is actually good news for consumers. Prices for panels will continue to remain cheap as the industry shakedown continues, making residential solar systems remarkably competitive to install and operate in large swaths of the continental United States. Any renewable systems vendor will tell you that there is no better time to install a solar array than today. As the green sector itself continues to experience phenomenal growth, low PV module prices will actually aid in the adoption and distribution of solar systems. Developers, installers, consumers, and a large majority of the solar panel business chain have benefitted greatly. So while China’s cutthroat price war has wreaked havoc with U.S. manufacturers, it is widely viewed as a boon by the rest of the industry and by consumers.

Why Investing in Solar Technology is Still Essential

America’s solar manufacturing sector may be down and out, for now, but industry experts maintain that this is entirely normal – a coming of age if you will. History has demonstrated that at such low prices, thin film technology, the stuff being hawked by Solyndra, is simply uncompetitive. However, and this is very important, the U.S. should not simply give up on investing in the research, development, and commodification of solar technologies. While China may want to dominate the manufacturing sector, there’s no reason that the U.S. should neglect its competitive advantage in niche markets and in innovating new technologies. Absolutely not! But America needs to invest in manufacturing as well.

A very popular thread of thought is the idea that we should let China be content with simply making stuff, like shoes, toys, iPhones, and lower-tech solar panels, while we focus on researching and developing new technologies. The problem is that where manufacturing is, so too goes research and development. When that goes, innovation follows soon after. We have seen this time and time again, first with the automobile industry and then with the computer industry. In fact, the current trajectory of America’s solar industry is highly reminiscent of the collapse of the nation’s once mighty semi-conductor industry, particularly in memory chips, in the late 1980’s as a result of foreign price dumping.

The truth is, America has been losing in many key industries. If we want to win this race for leadership in renewable energy, we will need to strengthen every segment of the renewable energy industry.

Not Enough Investment in Domestic Solar

Currently, the United States invests about 6 billion dollars in the solar industry – a far cry from the 15 to 25 billion dollars recommended by leading experts. We need to increase investment by nearly fourfold to remain competitive. With the domestic oil and gas industry heating up, and wallets still tight from the Great Recession, the needed investment will not be easily forthcoming in the years ahead. Nonetheless, renewables need to be prioritized. Critics contend that if renewables becomes competitive, they will naturally take over the market. In reality, markets hardly operate to any form of economic ideals – as the recession made painfully clear. Money in the form of investments must be committed to greasing the wheels of industry and teasing the market into shape. In fact, the energy sectors perceived to be the most cost effective today, namely oil and gas, are built on a thick foundation of taxpayer money and a long history of government husbandry. While oil and gas may be a mature market by any standard today, it still receives a lion’s share of the public investments made in the energy sector.

The Beginning of the End, or Just Beginning?

The truth is that the United States is one of only a handful of nations uniquely positioned to take over the energy leadership of tomorrow. Our culture of innovation, a transparent system of capitalism, and a network of top-tier research institutions give us an edge over other contenders. The real problem is, will we have the foresight and the willpower as a nation to leverage those strengths and reassert our global energy leadership? Could the coming decades reveal an America again dominating the energy markets of the world, or will it be another period of reliance on imported foreign goods, foreign technologies, and foreign innovation?

Solar Technology

Solar Technology Solar Technology Solar Technology Solar Technology Solar Technology Solar Technology Solar Technology Solar Technology Solar Technology

Leave A Comment