How Much Does Solar Cost?

It’s Not Just for the Wealthy

By NATiVE Solar Consultant David Henry

The number one question people ask about solar is “How much does solar cost?” Naturally, most people also assume it is prohibitively expensive and some others even feel it never can pay for itself. This has suppressed solar sales to mostly affluent people but in fact anyone with decent credit and who owns their home can afford it and the data shows that even low income homes are starting to become aware of this.

In this blog we’ll briefly examine how even low income homes are going solar to save money as well as get a sense of what demographics are installing on their homes.

Are low income homes getting solar panels now?

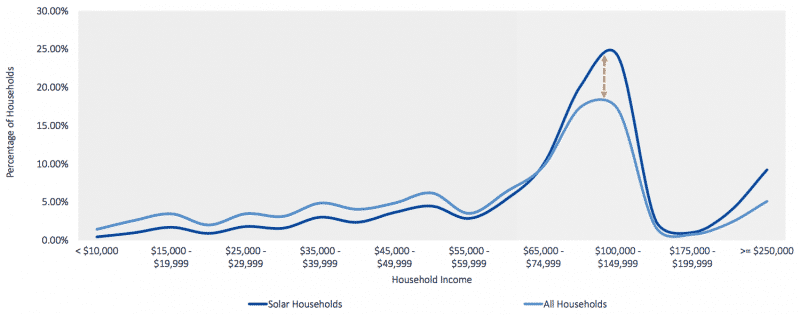

According to statistics published by the Solar Energy Industries Association, yes they are. An associate blogger said of the study, “One of the key findings is that more than 70% of solar households have annual income between $45,000 and $150,000, a range roughly aligned with ‘middle-income’.”

“This doesn’t mean low-income households are not getting solarized. The study says they are underrepresented in comparison with the general population, have also accounted for a significant share of solar capacity with a GTM estimated 530MW of installations in the four states covered in the study.”

So, how does any income ranged homeowner go solar? They finance them and by doing so take a monthly loss and turn it into an investment.

I am going to say that again, but differently. They realize they will either lose money every month essentially renting power forever, or go solar and rent to own their power.

Let’s see a real example from a recent home we did:

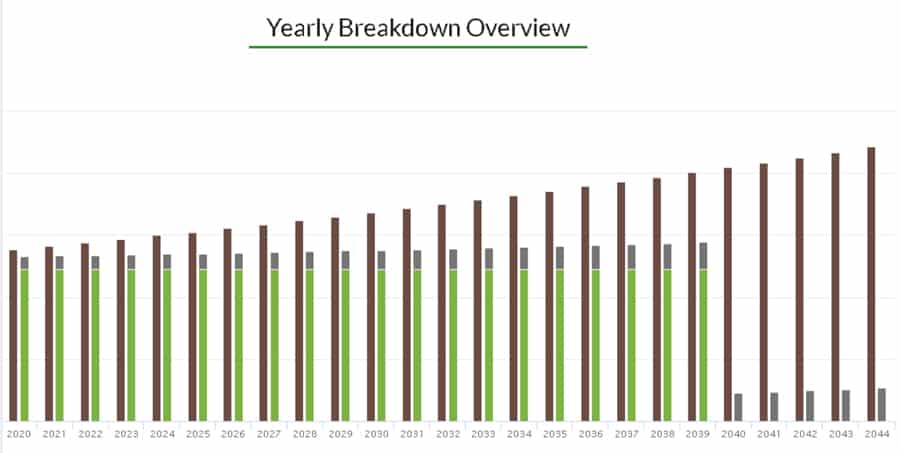

In this case, the homeowner’s loan payment plus any small residual payment to the power company (some markets have unavoidable fees) is represented by the green + grey bars while not going solar and renting power forever is represented by the brown bar. Assuming just a small, 1-2% inflation you can visually see some interesting points:

- In the first year this homeowner spent less by going solar plus a small fee to the energy company than not going solar. This is called cash flow positive.

- As time goes on, the loan is free from the burden of inflation and the monthly and added up yearly savings start to take off.

- Eventually the loan is done and the gap between not going solar and solar is in the thousands each year.

By going solar, on a loan, this person is already saving money right away.

Why is it smarter for anyone of any income to use loans to go solar?

With cash, you’d be locked into the investment for, depending on the market, 4-10+ years before you see returns. That’s okay, it’s still something you’ll pay for (energy) anyways, and the panels would be overall cheaper, but why not invest the cash into a market AND convert your existing monthly payment for power to a payment to own a power station on your roof? These lower income homes likely didn’t have the cash laying around anyways and their limited choice would still have been the right one even if they acquired the capital.

In this way, taking a lost expense we all face and paying towards a loan is how any income level home can save by going solar. You can learn more about solar loans from our Solar Chats Vlog Series Episode: Can a Loan Save You Money?

I welcome all comments or questions below, or directly at david.henry@nativesolar.com and feel free to challenge the math or logic in a discussion format.

Leave A Comment