Most people understand the basics of supply and demand. The more people that want something, in this case energy, the more it will cost. Likewise, the less of it there is, the more it will cost. Unfortunately, the nation’s primary fuel sources suffer from both dwindling supply and skyrocketing demand. In other words, our current energy policy model has an expiration date. This is all the economic theory it takes to explain why fossil fuels could never realistically be the energy source of the future.

The recent shale gas boom, and the glut of domestic oil production unleashed in recent years seems to have temporarily allayed fears of a carbon energy shortage – for now. But the laws of supply and demand haven’t changed. It takes millions of years, and perfect geological conditions, to create a droplet of oil, a pebble of coal, or a wisp of gas – which humans burn up in mere seconds. In fact, the United States alone consumes nearly 7 billion barrels of oil, and billions of tons of coal, in a single year. It should come as no surprise then that we will be running out of the stuff sooner rather than later, at least the easily and feasibly extractable stuff.

In fact, if the natural gas fracking boom and the increasing reliance on extreme deep-water oil rigs is any indication, we’ve mostly already consumed or tapped into all the low hanging fruit anyways. That means we will have to rely on increasingly costly and dangerous methods of extraction in order to satisfy an exploding global appetite. It is quite simple really. The trajectory of the curve for fossil fuel prospects nosedives into an abyss of diminishing returns.

The Carbon Death Spiral

Regardless of what technological breakthroughs open up new, unconventional reserves of carbon energy, the fact is that it takes energy to extract energy. A conventional well in Saudi Arabia can produce 100 barrels of crude with the energy equivalent of a single barrel of oil – a one-hundred to one ratio. Not bad, but that won’t last much longer. Today, the EROI, or energy return on investment, on carbon sources is considerably lower. For oil shale and tar sands, it takes about 1 barrel of equivalent energy to produce 2 barrels of crude. Deep sea drilling operations, such as the Deepwater Horizon, fare somewhat better in terms of efficiency, but bring to the table a whole set of other dangers and complications.

Realistically, for oil and gas companies to make a profit with such low EROI, they must raise prices which effectively translates into the pain at the pump most consumers are feeling now. It’s not unlike wringing water from a soaked towel. The more you wring, the less water there is to wring out. You may wring harder (i.e. develop novel and expensive new technologies for extraction) in order to get more water, but in the end, there is a limit. At some point, we all have to realize that the towel isn’t going to get much drier, and that fossil fuels won’t ever be cheap again.

Drilling Ourselves Into a Hole

Most people would be surprised to know that fracking or hydraulic fracturing the current darling of the oil and gas industry is actually a very old technique first applied in Texas in 1947. In the 1970’s and 1980’s, the Department of Energy invested heavily in the research and development of fracking technologies, leading up to the state of the technology today. The point is that it took more than half a century and much taxpayer money to make fracking a viable technology, and all this in order to simply prolong our reliance on fossil fuels. Oil and gas advocates contend that new technologies will ensure that the United States will continue to have access to both conventional and new, unconventional reserves of fossil fuels. But, they are missing the point entirely.

The goal is not to ensure that we have enough oil and gas, the goal is to ensure that we have enough energy no matter the source. Most advocates of carbon energy have tunnel vision. They keep wringing the same towel. My question is simply this: is it worth it to continue wringing that same dry towel? Is a single fuel source worth the consequences of global warming, political instability, and environmental degradation? The truth is that while increasing domestic production of energy through more drilling or more fracking may offer some temporary relief, we should ask, “Are we drilling our way to freedom, or drilling ourselves into a deeper and deeper hole?”

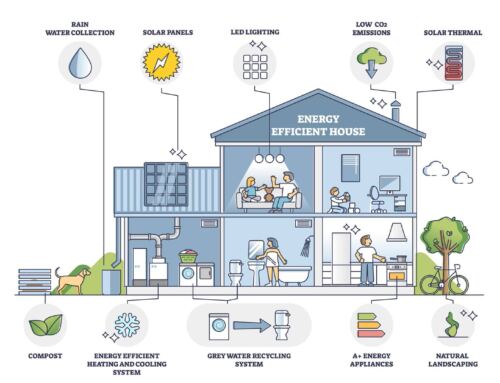

The Potential of Renewables

The very definition of the word “renewable” is that it can’t be “used up”, so to say. In that sense, energy sources that are renewable play by a different set of rules. They are not affected by the law of diminishing returns – provided we can develop the right ways to utilize renewable sources such as the sun, or wind, or the moon’s tidal pull. But making renewables a priority can be difficult when other entrenched industries obfuscate the issues, preventing us from making the investments that matter. The problem is exacerbated by the inherent scarcity of public funding for research and development, which often becomes a zero-sum game that, until recently, the fossil fuel sector wins quite handily.

Nonetheless, growth in the green industry has been spectacular to say the least, mirroring a slow shift in market dynamics as people realize that it might be wiser to invest in other more promising energy prospects. The renewable sector is pushing past what entrepreneurs have termed the valley of death portion of the emerging industries curve. Unlike fossil fuels, however, there is no expiration date.

Energy Policy

Energy Policy Energy Policy Energy Policy Energy Policy Energy Policy Energy Policy Energy Policy Energy Policy

Leave A Comment