Texas Electricity Costs Are Set to Rise — and Federal Policy Just Threw Gas on the Fire

Texas Electricity Costs Are Set to Rise — and Federal Policy Just Threw Gas on the Fire

By Adam Glick, Solar Sherpa, NATiVE Solar

Texas Power Bills: Already Trending Up

- As of 2025, the average residential electric bill in Texas is $170.63/month, up from $165.94 in 2024 (ChooseTexasPower).

- Texans now pay roughly 14.8¢ per kilowatt-hour, about 25% more than in 2021 (EIA).

- ERCOT’s own forecasts show that reserve margins could tighten further this summer as demand peaks. (this also raises prices…)

What’s Fueling the Climb?

1. Demand Is Exploding

Texas’s population boom, tech growth, and industrial electrification are driving demand at an unprecedented pace.

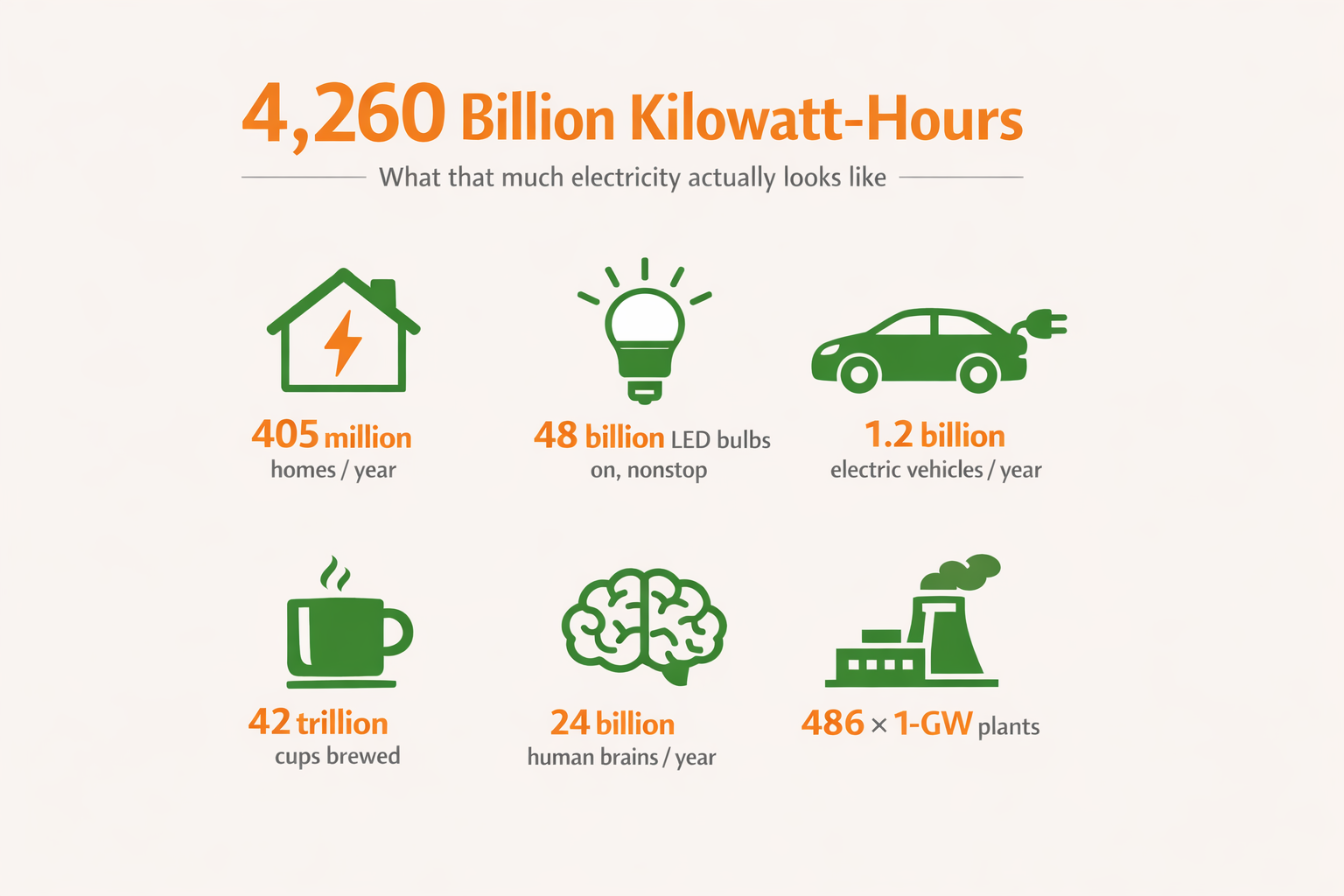

“We expect electricity demand to nearly double by 2030.”

-ERCOT CEO Pablo Vegas (AP News)

Major demand drivers include:

- AI and data center growth

- Crypto mining operations

- Climate change (weather is getting hotter and more violent more ofetn)

2. Supply Costs Are Rising

- Natural gas prices are expected to rise roughly 24% over the next 18 months (ComparePower).

- New power plants now cost 30–100% more to build than just two years ago (Reuters).

- Post-Winter Storm Uri grid upgrades are costing ratepayers more than $30 billion in infrastructure surcharges (ElectricityPlans).

The Big Beautiful Bill: Making a Bad Trend Worse

Let’s be clear: Texas electricity costs were already climbing before the One Big Beautiful Bill passed. But by eliminating key clean energy incentives and phasing out the 30% solar tax credit, the bill removes the very policies that were helping stabilize long-term prices.

According to Energy Innovation modeling:

- Texas is expected to lose77 GW of planned, new, clean energy capacity — enough to power 19 million homes.

- As a result, wholesale electricity prices could jump 25% by 2030 and up to 74% by 2035.

- Household electric bills could increase by $220/year by 2030 and $480/year by 2035.

“Instead of adding 104 GW of new electricity supply in the next 10 years, Texas is now expected to add only 27 GW.”

-Daniel O’Brien, Energy Innovation

“We are, in essence, pulling the rug out from underneath these projects.”

-Harry Godfrey, Advanced Energy United

The end of solar and storage incentives doesn’t just hurt project developers — it limits competition and future supply, which in turn puts more pressure on fossil fuels and further increases consumer costs.

What This Means for Texans

| Trend | Retail Electricity Rate Impact |

|---|---|

| Surging Demand | Grid strain and price spikes during summer peaks |

| Higher Supply Costs | More expensive fuel and new construction passed on to customers |

| Loss of Clean Energy Incentives | Less new generation, less competition, higher rates |

What You Can Do Right Now

- Be mindful of how your consume electrical energy – conserve where and when possible

- Complete solar + battery storagesystem installation while the 30% tax credit still exists (through 2026)

- Stay informed — monitor ERCOT alerts and understand your utility’s pricing structures

Final Thought

The Big Beautiful Bill didn’t create Texas’s energy cost problem, but it’s going to make it worse by removing critical tools that were helping keep future rates in check. A rapid acceleration of rising energy costs (ie electricity bills) starts now.

If you’re a Texas homeowner or business looking for cost stability, now is the time to act! Solar and storage aren’t just good for the grid — they’re a smart hedge against an increasingly unpredictable energy market.

Take control of your energy future now — or risk paying a whole lot more for it later.

Get Started with NATiVE Solar or call us at 855-234-3131

Leave A Comment