Coalitions Rising: How the Solar Industry Is Organizing to Clear the Roadblocks

Coalitions Rising: How the Solar Industry Is Organizing to Clear the Roadblocks

By Adam Glick, Solar Sherpa, NATiVE Solar

The solar (and solar-adjacent) ecosystem is building coalitions to push through bottlenecks in permitting & interconnection, transmission, manufacturing/import, law-making, deal-making and social license. All this is happening just as policy turbulence, geopolitics and rising energy price pressures add friction and urgency.

Here, dead reader, we’re going to zoom in on solar + smart-energy coalitions gaining voice and leverage in the U.S. and abroad: what’s new, who’s organizing, and what’s actually moving the needle across economic, geopolitical, regional, social, legal, and environmental fronts. Let’s dive in…

The global clean-energy ship has clearly set sail

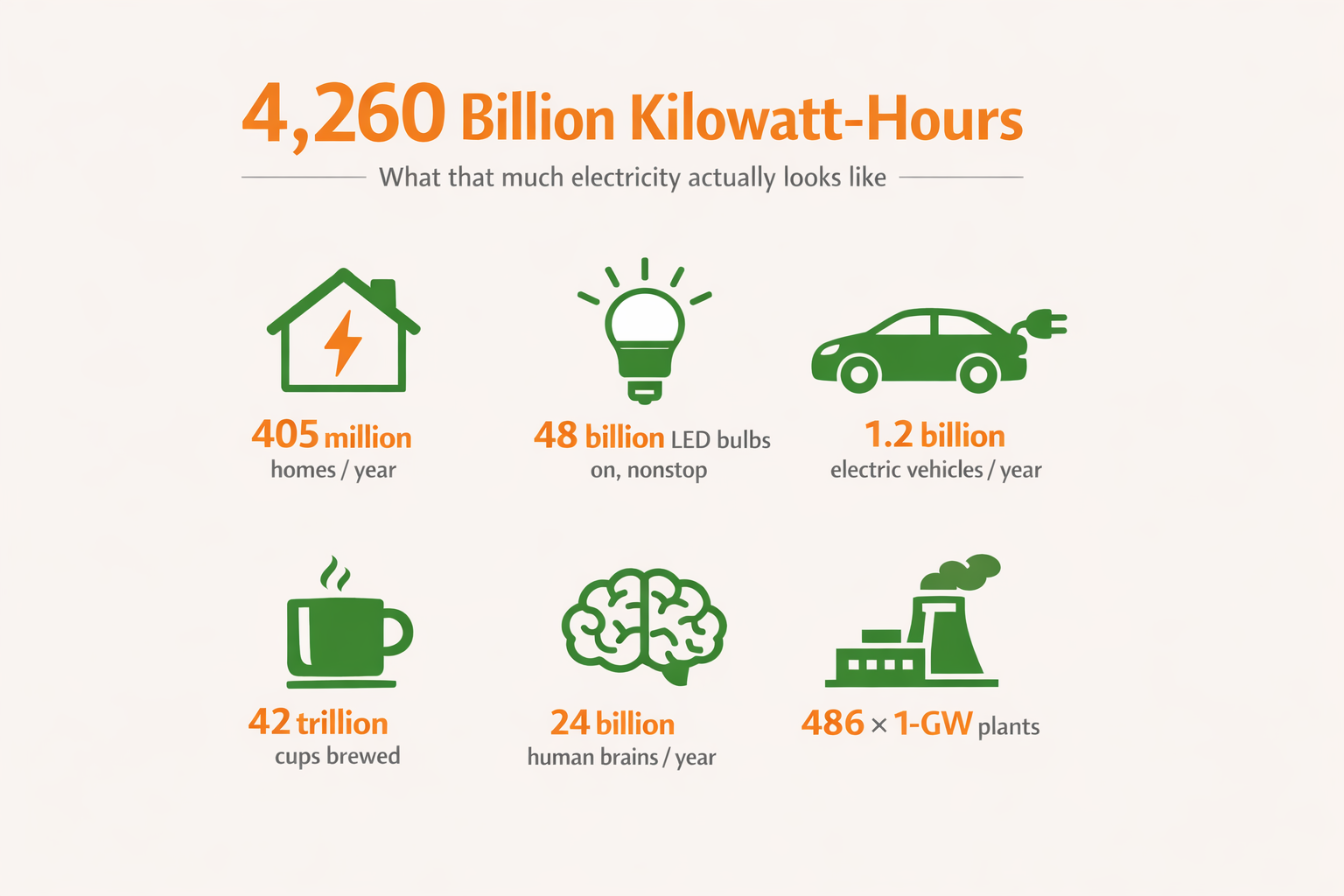

By the end of 2025, global energy investment is set to reach $3.3T in 2025, with ~$2.2T flowing to “clean” energy (renewables, grids, storage, efficiency, electrification, etc). This is about twice fossil investment and the largest clean-energy investment totals on record (IEA WEI 2025; full report PDF here; news: Reuters). Cool!

Even with all the political and supply chain chaos we hear about, solar remains the dominant growth driver in the outlook – and wind/solar generation surpassed coal globally in H1’25 (Guardian; also Reuters). The IEA (International Energy Agency) did trim near-term renewables growth based on U.S./China policy shifts, but still shows solar carrying ~80% of additions (Reuters).

Here in Texas, ERCOT shattered solar output records this summer – peaking near ~29.9 GW on Sept 9 – and set multiple evening storage-discharge records (>7 GW), with solar meeting ~15% of summer demand and batteries smoothing the ramp (IEEFA; Canary Media; ERCOT PDF notes: ERCOT Monthly; live record tracker: GridStatus). Cool!

Texas also overtook California in installed grid batteries (~14 GW+) by Q3 (S&P Global Commodity Insights). Very cool.

Headwinds

But folks, despite lots of encouraging numbers, stormy seas remain ahead. Luckily, the threats are now pretty articulated and well-understood.

- Trade : tariffs and supply chain issues are driving uncertainty – this pushes up pricing and makes investment more risky

- Policy & Law-making : On Oct 2, 2025, DOE terminated $7.56B across 223 projects (DOE; Reuters), prompting legal challenges (see “Legal” below).

- Tax credit resets (U.S.): The One Big Beautiful Bill Act (OBBB) and Senate provisions scale back/phase out several IRA-era credits and incentives, with differing timelines by technology and marketplace (Congress.gov H.R.1; analysis Holland & Knight; BPC explainer; news Reuters).

- Social license: Local and group opposition to solar farms and battery storage is still a challenge for solar and renewable energy advocates and commerce – Especially after high-profile fires; dozens of communities have enacted rules that won’t help our energy situation. (AP News).

The IEA has lowered the 2030 renewables forecast on U.S./China policy changes, even as solar still leads growth (Reuters). But there is strength in numbers…

The coalition moment/movement in solar

Many organizations and coalitions have been formed and are quickly gaining the power to help clear long-standing (and newer) roadblocks that exist in the path to accelerated solar and smart energy adoption. Here’s a few that are bringing together public/consumer advocacy groups, academia, law-makers, and other stakeholders to effect real, positive, and effective resistance in the face of renewable energy threats:

- Manufacturing: SEMA Coalition coordinating policy & investment to reshore PV supply chains (“build solar in America”).

- Transmission: ACEG (interregional lines, Order 1920 implementation), ACORE’s Macro Grid Initiative, and the WATT Coalition (grid-enhancing technologies like dynamic line ratings/topology optimization) align business, labor, and NGOs to unlock capacity.

- Permitting (at scale): SolarAPP+ takes residential solar permitting from days to same-day in participating jurisdictions; states like Washington Commerce and Minnesota Commerce are funding adoption.

- Interconnection reform alliances: FERC’s Order 2023 and Order 1920 (planning & cost allocation) push “first-ready, first-served” and require planners to study long-term needs and GETs; regional pilots show movement (Utility Dive: MISO; Utility Dive: SPP). PJM is also deploying AI with Google/Tapestry to accelerate studies (Reuters; PJM lines).

- Global coordination: In Europe, the European Solar PV Industry Alliance (ESIA) and SolarPower Europe align policy under the NZIA; globally, the Global Solar Council amplifies solar + storage advocacy.

And right here in Texas, we have a large and growing list of organizations “fighting the good fight” – some of which NATiVE Solar is an active member:

- Texas Solar + Storage Association (TSSA) – statewide trade group advancing solar and storage (formerly “Texas Solar Power Association”). txsolarstorage.org

- Texas Solar Energy Society (TXSES) – nonprofit educating Texans on solar adoption (chapters statewide). txses.org

- Solar United Neighbors – Texas – member-based consumer advocacy, co-ops, and policy work in TX. solarunitedneighbors.org/locations/texas

- Environment Texas – state advocacy arm focusing on clean energy/solar policy and local reforms. environmentamerica.org/texas

- Public Citizen Texas – consumer/environmental advocacy with active solar campaigns/events. citizen.org (Texas)

- Conservative Texans for Energy Innovation (CTEI) – conservative clean-energy policy advocacy. conservativetexansforenergyinnovation.org

- Advanced Power Alliance (APA) – industry association supporting advanced/renewable power across the ERCOT region (Texas-centric influence). poweralliance.org

- SPEER (South-central Partnership for Energy Efficiency as a Resource) – TX/OK regional org; policy & DER participation in ERCOT (often allied with solar outcomes). eepartnership.org

- CleanTX (incl. legacy TREIA) – Texas cleantech/renewables network that merged with TREIA; hosts events and policy-minded networking. cleantx.org

- TEPRI (Texas Energy Poverty Research Institute) – equity-focused research/advocacy on affordable clean energy access in Texas. tepri.org

- Texas Solar for All Coalition – statewide coalition (led by Harris County & partners) to expand rooftop solar for low-income households. solarforalltexas.org • Background: EPA award + partner pages – EPA announcement • HARC overview

- Clean Energy Fund of Texas (TxCEF) – green bank-style nonprofit participating in TX Solar for All coalition. cleanfundtx.org/solar-for-all

About Amicus Solar Cooperative: scaling collaboration through shared values

As a long-standing member of Amicus Solar Cooperative, NATiVE Solar is part of a national network of independently owned solar companies that share resources, best practices, and purchasing power – along with active lobbying and legal advocacy – to strengthen the entire clean-energy ecosystem. Amicus demonstrates how cooperation – rather than competition – can accelerate equitable growth, improve supply-chain resilience, and uphold high ethical and quality standards across the solar industry. This collective model helps smaller regional installers like NATiVE Solar access the same economies of scale as national players, while maintaining their local focus and community ties.

Together, all of these efforts (and more) aim to help make the solar supply chain more secure and resilient, while keeping the industry’s momentum strong despite geopolitical tensions. Sounds pretty smart.

Fresh legal action

In a timely note – just this past week, coalitions of unions, nonprofits and solar companies sued in federal court to reverse the EPA’s cancellation of the $7B Solar for All program (Reuters; AP News; plaintiffs overview: SELC).

And earlier this year, amid years of rapid solar growth and perennial complaints about bad actors in our unregulated solar market, SB 1036 created a state licensing & oversight program for residential solar retailers (effective Sept 1, 2025) – a trade-supported step to preserve market momentum while protecting consumers. Here Texas Solar + Storage Association (TSSA), Senator Judith Zaffirini, Representative Drew Darby, Texas Department of Licensing and Regulation (TDLR) found common ground with each other – and worked with legislators who passed the bill. (NATiVE Solar supports this new Texas law 100% and is implementing it ahead of the mandated timeline!)

What the coalitions are up against – and how they affect forward action

1) Interconnection & transmission capacity

The backlogged interconnection queue (for connecting new solar farms and batteries to the grid, for instance) is still a huge choke-point. FERC’s transmission planning rule (Order 1920) and interconnection reforms (Order 2023) push first-ready/first-served clusters, long-term planning, and encourage grid-enhancing tech. MISO/SPP reforms and PJM’s AI collaboration point to shorter studies and clearer timelines (MISO; SPP; Reuters). But there’s a lot of partisan and Big Oil lobbying to work through.

2) Permitting friction

Residential and Commercial solar/battery permitting remains very costly, inefficient and time-consuming compared to most other places in the world. But it doesn’t have to be this way. Residential: SolarAPP+ delivers automated, same-day permits where adopted; states are helping cities onboard (Washington Commerce; Minnesota Commerce). Utility-scale: Some federal rulemaking and standardized data/process tools (released under the previous administration and still applicable) are giving local/regional AHJs (authorities having jurisdiction) and utilities clearer benchmarks. Here, coalitions provide the playbooks and political cover to copy/paste best practices into new rules.

3) Supply-chain security & geopolitics

The International Energy Agency (IEA) recently updated its forecast to reflect new U.S. and Chinese policies that are reshaping global trade in solar materials and equipment. Growth projections are now slightly slower than before – but solar energy still leads all other sources in new capacity additions (Reuters).

In response, U.S. and European industry groups – including the Solar Energy Manufacturers for America (SEMA), the European Solar Industry Alliance (ESIA), and SolarPower Europe – are advocating for:

- Local manufacturing and content rules to reduce reliance on imports,

- Long-term purchasing agreements to stabilize demand, and

- Targeted financing programs to help new solar factories compete globally.

4) Social License & Land Use

Community opposition to large-scale solar and battery projects is growing across the U.S., including Texas, as residents raise concerns about land use, habitat impact, and visual change (AP News). All voices count! But who will have the loudest or most heard voice in the room?

In response, developers and advocacy groups are building social license by pairing projects with local benefits and smart siting strategies:

- Conservation-aligned siting: Tools like The Nature Conservancy’s Site Renewables Right map lower-conflict areas where renewable energy can be built while protecting wildlife and natural resources.

- Agrivoltaics and dual land use: Groups such as the American Solar Grazing Association promote co-use of solar sites for grazing and agriculture – helping rural landowners benefit from both clean energy and farm income.

- Community partnerships in Texas: Local organizations like the Texas Land & Liberty Coalition and the Texas Solar Energy Society (TXSES) work to educate communities, align solar development with local priorities, and reduce conflict over siting. (NATiVE Solar is a very proud to be an active member of TXSES!)

Together, these approaches show that solar and storage can coexist with conservation, agriculture, and rural development – strengthening community trust while expanding clean energy. This feels for sure.

Playbook: what approaches seem to be working in 2025

- Bundle “wires + software.” Pair long-lead interregional lines (ACEG / Macro Grid) with near-term GETs (WATT: dynamic line ratings, topology optimization) to free capacity in months, not years (ACEG).

- Automate the simple stuff. SolarAPP+ plus state grants → instant permit wins; publish adoption scoreboards and ready-to-use ordinances (NREL SolarAPP+;)

- Common rails for interconnection. Align cluster milestones (FERC 2023), planning (FERC 1920), fast-track pilots (MISO / SPP), and digital tools (PJM / Google AI) to cut queue time and uncertainty (FERC 2023; FERC 1920; MISO; PJM / Google AI).

- Reshore strategically. Coordinate SEMA / ESIA advocacy & offtake constructs to make local PV bankable through cycles (SEMA; ESIA).

- Earn trust locally. Partner early with grazing co-ops / conservation orgs; site on low-conflict land; provide visible community value (ASGA)

What to watch next (Q4’25 → Q1’26)

Here’s what we’re watching in this space starting now:

- Transmission rule implementation: States’ roles under FERC 1920 and subsequent rehearings; how regions bake long-term need & cost allocation into plans (FERC).

- Queue throughput: Do MISO / SPP / PJM pilots materially cut study times and cancellations? (watch regional updates and PJM AI rollout: Reuters).

- Policy recalibration: Fallout from federal cancellations and how private capital + states backfill (e.g. record private funds like Brookfield’s $20B ET fund).

- EU solar manufacturing: ESIA forum outcomes and NZIA implementation (targets & action plan: EU NZIA background: Reuters).

As always, dear reader, we’ll keep you informed as there is more to report here!

Get in touch with us or call us at 855.234.3131 and let us help with your solar and smart energy-related needs.

Leave A Comment