Austin Startup Raises a Billion Bucks to Put Big Batteries Everywhere (and connect them together)

Austin Startup Raises a Billion Bucks to Put Big Batteries Everywhere (and connect them together)

By Adam Glick, Solar Sherpa, NATiVE Solar

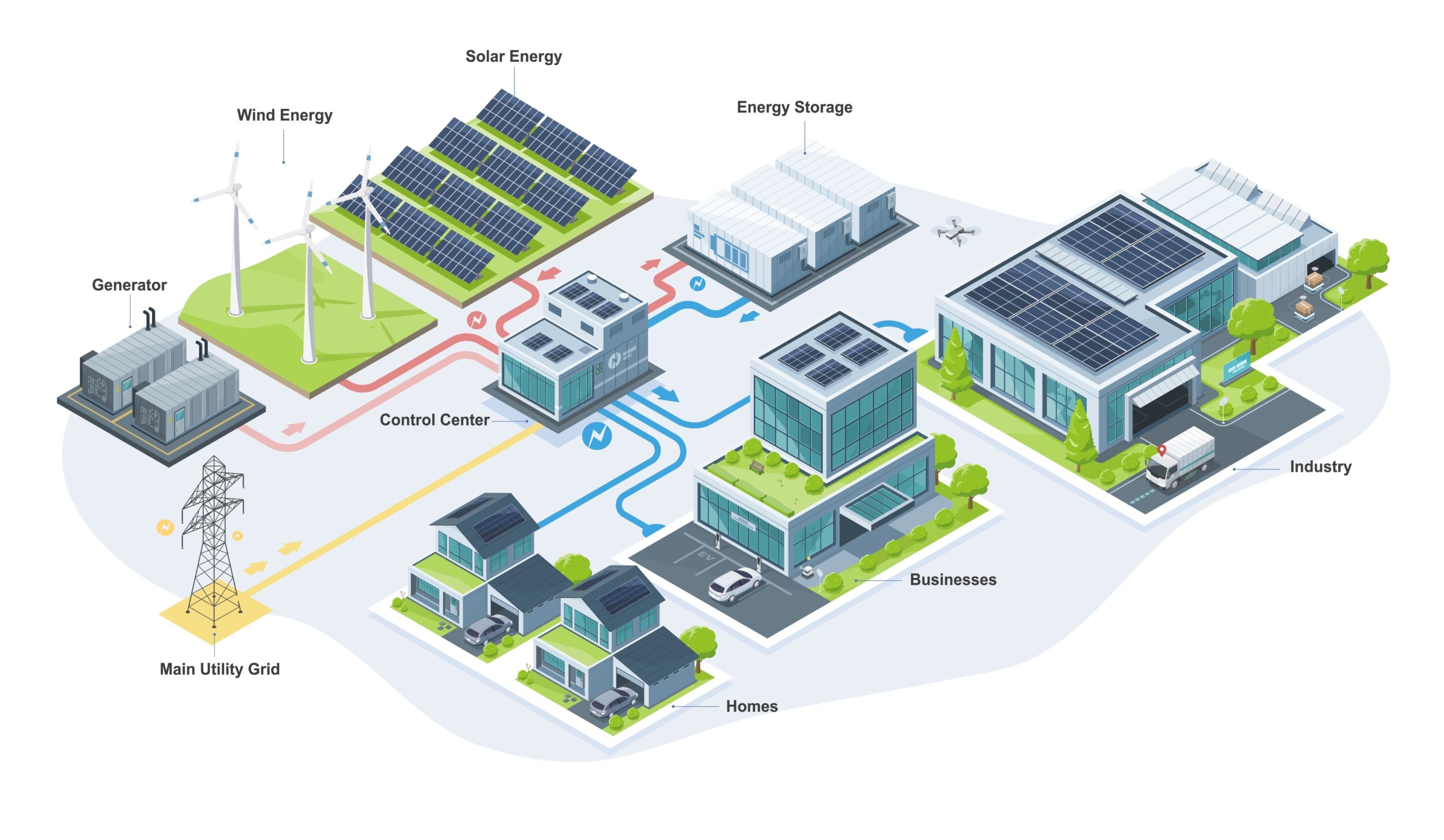

Here’s a thing to know: When enough large battery energy storage devices are linked together into a local distributed energy network (DER) you start reshaping the grid from a one-way highway into a flexible neighborhood network (aka “microgrid”). Texas is already testing this through ERCOT’s ADER (Aggregated Distributed Energy Resource) program and utility pilots. The upside: resilience and lower peak costs. The friction: interconnection rules, data/telemetry, fair compensation, and who’s in charge during an emergency.ERCOT+3Business Wire+3TechCrunch+3

The Big News : an Austin startup, Base Power, recently raised $1B to put big home energy storage batteries everywhere. They’re now building out the old Austin American Stateman building as their new HQ and battery factory. Given all the negative press that funding in the renewable energy sector has gotten lately, this is pretty fantastic news. This new startup raised this huge stack of capital to expand affordable whole-home battery backup and manufacturing in Texas. Their model pairs below-market retail power with 25-50 kWh batteries (you can go much larger though). The other part of their model actually connects multiple installations together and “aggregates” the power across local sections of the power grid. Aside from manufacturing and selling battery energy storage, they are also a licensed energy provider with ERCOT. They’re a proper electric utility company!

Changing the “shape” and function of the grid

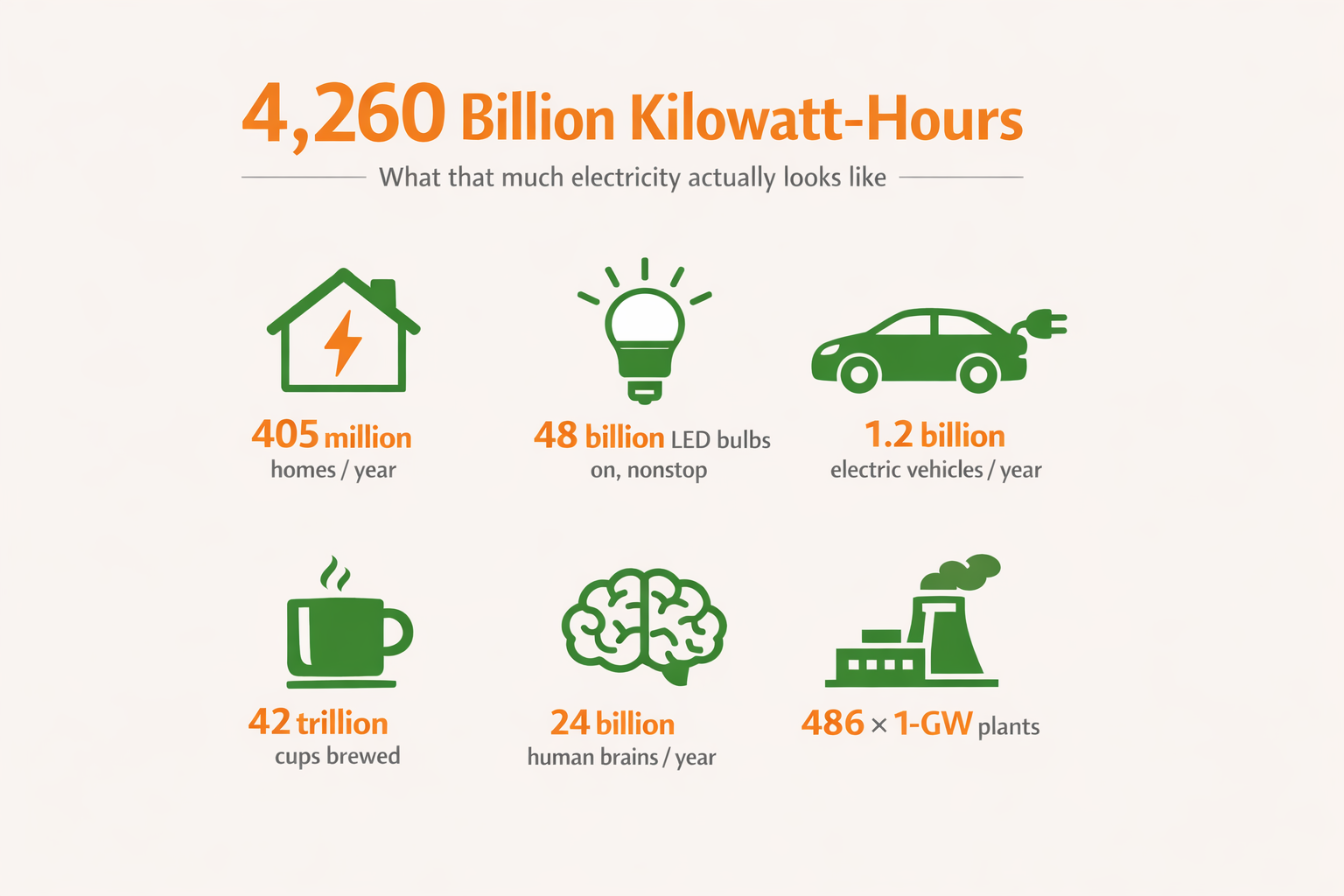

In just two years, the company says it’s sold 100+ MWh of residential storage in Texas -already the scale where aggregation begins to act like a small power plant (a.k.a a “VPP”) . TechCrunch

Why it’s structural, not just another funding headline: When tens of thousands of homes synchronize battery energy storage capacity, the functional topology of the grid changes. The edge can now support the center -smoothing peaks, riding through outages, and even selling services back to the market as a “virtual power plant” (VPP). DOE calls VPPs a cost-effective way to meet near-term grid needs. Smart Energy Decisions

The rapid emergence of VPPs in Texas and beyond

Texas is running one of the country’s most important DER (“distributed energy resource”) and smart energy storage aggregation experiments: ERCOT’s ADER Pilot, which lets fleets of small devices (like home batteries) bid into the wholesale market as a single resource. The program moved into Phase 3 this summer, expanding participation options and consumer payouts. ERCOT+1

You can already see it in the wild:

- Base Power + Bandera Electric Cooperative (Hill Country) : Leasing whole-home batteries to members, designed to support both backup and grid value. PR Newswire

Tesla Electric VPP (ERCOT pilot): Powerwall owners pool capacity to provide grid services. Tesla

- Integlligent Octopus VPP : Quickly growing across the unregulated Texas residential energy marketplace. (We’ve written a lot out this option recently)

GVEC + Tesla: A “first-in-Texas” utility-scale VPP program with enrollment incentives for homeowners. MySA+1

What this unlocks:

Peak shaving without new (gas/coal-powered) “peaker plants”

Fast, local resilience when a line trips or a storm hits

Price stability by shifting demand, distributing energy resources, and shared-exporting during higher levels of energy scarcity

Could neighborhood-scale microgrids emerge?

Short answer: yes –in two ways.

Virtual microgrids (software-defined): homes remain connected to the larger grid but operate as a coordinated fleet via ADER/VPP programs. This is the path of least resistance today. ERCOT

Physical community microgrids (hardware-bounded): campus, critical facilities, or neighborhoods that can island. Texas just approved ~$1.8B for a statewide microgrid program focused on critical sites (hospitals, water, emergency services), with many projects capped around ≤2.5 MW for speed and replication. That funding primes the supply chain, know-how, and standards needed for community-scale projects that can eventually trickle into residential developments. Canary Media

Again, I’ve written fairly extensively on this topic in recent months. Take a deeper dive on VPP’s and microgrids here

What resistance or friction in the from within the industry should we expect?

Even as energy storage aggregation scales and gains traction, three layers of pushback typically show up:

Distribution safety & capacity: Utilities need high-fidelity telemetry and control so fleets don’t overload local lines or backfeed unsafely. ERCOT’s Phase-3 ADER rules lean into better definitions of controllability and participation models. ERCOT

Market design & compensation: In most U.S. markets, FERC Order 2222 requires RTOs to let DER fleets compete; ERCOT is largely outside FERC’s jurisdiction, so Texas is building its own framework (ADER). Expect debates over double compensation, performance baselines, and who gets paid for which service. Federal Energy Regulatory Commission+2ProMarket

Retail & customer protection: Clear disclosures (backup vs grid services), opt-in control, and data privacy/cybersecurity are table stakes -especially when third-party aggregators can dispatch devices during scarcity events. (Texas consumer-protection and interconnection rules -e.g., PUCT §25.211/25.217- form the scaffolding for safe DER growth.) Public Utility Commission of Texas

None of these are deal-breakers; they’re design problems. Texas is iterating fast -shifting the ADER pilot into ERCOT’s stakeholder process and expanding it to more resource types and participation models. Utility Dive

What to watch next (near-term signals that this stuff is really working)

Builder & co-op partnerships: When batteries come standard in new homes or are leased at scale by co-ops, aggregation grows predictably. (GVEC, Bandera, Lennar pilots are early markers.) MySA

Manufacturing in Texas: Domestic plants compress lead times and costs; Base says it will expand U.S. manufacturing tied to this raise. Business Wire

ADER Phase-3 outcomes: Look for broader device eligibility, simpler telemetry, and pathways from pilot to full market rules. ERCOT

Microgrid grants: Awards under the new state program -especially community-adjacent projects (water, communications, shelters)- will seed local expertise that can spill over into neighborhood designs. Canary Media

We’re huge proponents for battery energy storage -and the new wave of battery storage aggregation approaches being spun up here inn Texas and around the world! I can’t wait to go visit the local BASE manufacturing and R&D facility here in Texas soon! -I’ll write about it here too!

A bit more about Base Power

Established in 2023 and headquartered in Austin, Texas, Base Power is a leading distributed energy storage technology company that delivers resiliency to homeowners and reliable distributed storage to utilities. With a team of experienced engineers and operators from renowned companies, Base has secured funding from prominent investors including Thrive Capital, Valor Equity Partners, Altimeter Capital, Trust Ventures, Terrain, and others. As a licensed electricity provider in Texas, Base operates its fleet of distributed storage devices similar to a utility-scale battery – enhancing grid stability during normal operations and providing backup power to customers in the event of grid failure. Customers benefit from reliable backup power and competitive energy rates, all without the high upfront costs associated with traditional home batteries or generators. Visit basepowercompany.com to learn more.

Leave A Comment