What’s Happening with Solar + Battery Storage Costs in 2026: What Texas commercial property and homeowners should know

What’s Happening with Solar + Battery Storage Costs in 2026: What Texas commercial property and homeowners should know

By Adam Glick, Solar Sherpa @ NATiVE Solar

What’s Happening with Solar + Battery Storage Costs in 2026: What Texas commercial property and homeowners should know

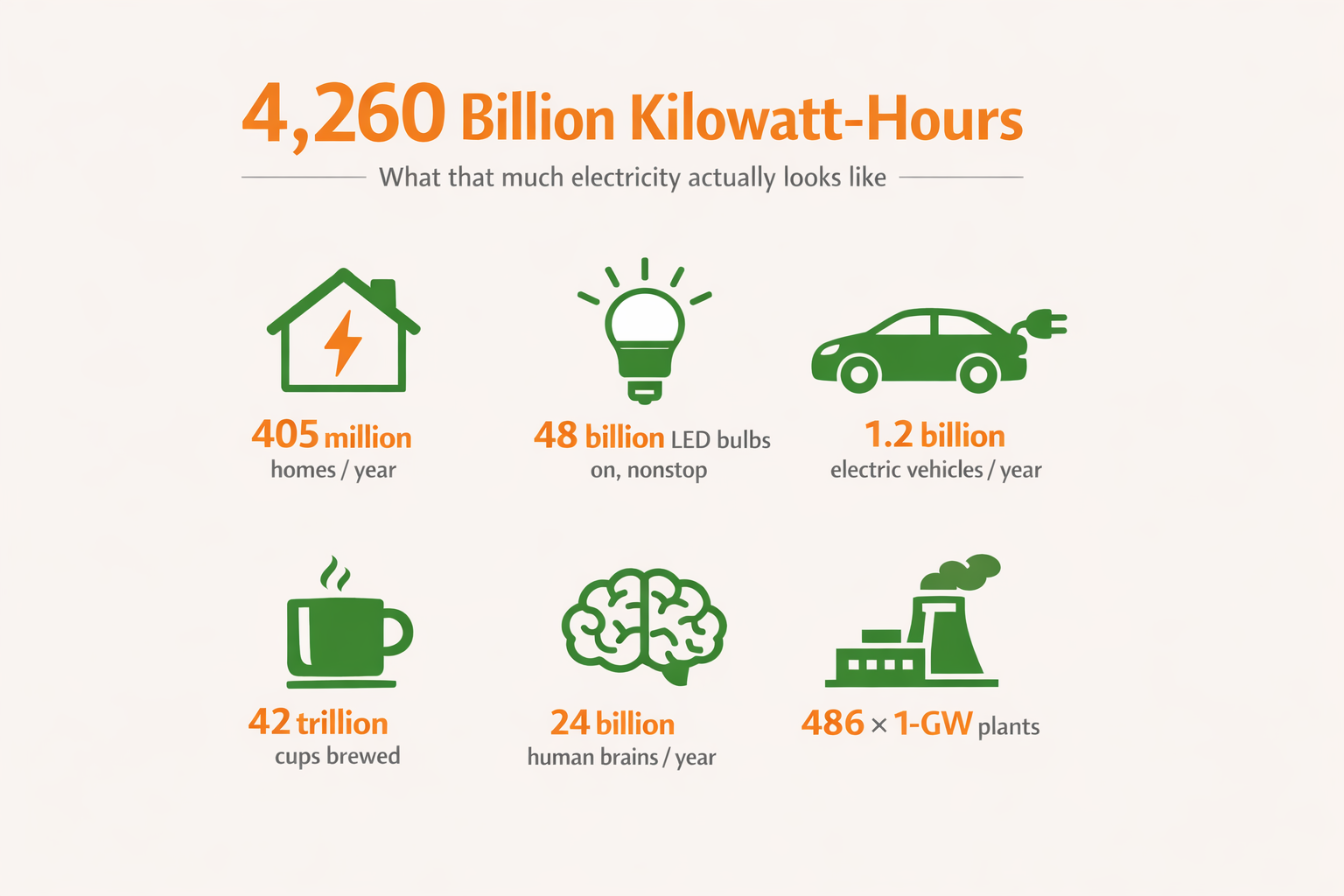

What’s Happening with Solar + Battery Storage Costs in 2026: What Texas commercial property and homeowners should knowIf you’re planning a solar (or solar-plus-storage) project in Texas in 2026, the most important pricing reality is this: some hardware component costs have been moving down modestly (ie batteries) and others are slightly higher vs ‘2025 (i.e. PV panels), while total installed “turnkey” pricing is, well….it often depends more on soft costs — engineering, labor, permitting, inspection, and interconnection. These costs may not really dropping all that much in the short-term…but that doesn’t mean *now* isn’t a great time to pull the trigger, either. :) Your local electric utility is going to keep piling on the rate hikes -that’s a given.

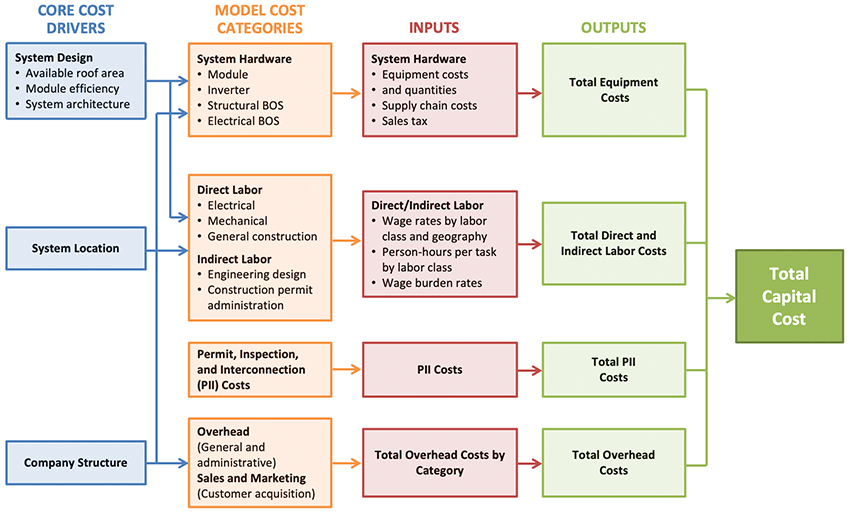

I wanted to give you, dear reader, a quick visual aid here to help explain all the factors that actually go to the final cost of a turn-key systemHere’s what it basically looks like for both commercial and residential smart solar project costs:

So what’s driving solar and battery storage pricing in 2026?

1) Lower Battery Pricing? Yes, slightly, perhaps.

Wholesale Lithium-Ion battery hardware prices are continuing to move lower a bit in China -but “pack price” is not what customers pay for premium installed backup systems. (*China manufactures about 95% of the world’s lithium ion battery cells -the “heart” of pretty much every modern battery -even the ones assembled in the U.S.)

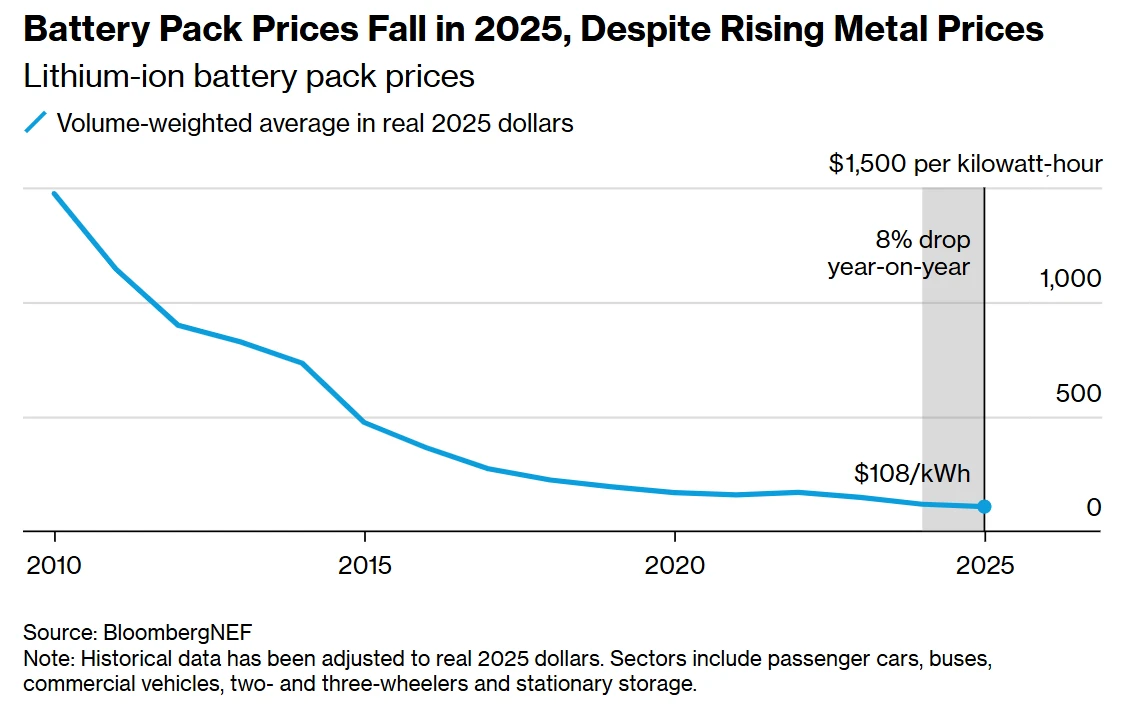

BloombergNEF’s latest battery price survey shows that the average lithium-ion battery pack price across applications fell to about $108/kWh in 2025, and the average pack price for stationary storage fell even further to about $70/kWh —

a measureable year-over-year drop for stationary storage packs. (BNEF: New record lows for battery prices)

The catch: those figures are pack prices (the battery pack hardware at or near the factory gate / supply chain level),

not the price of a fully installed, code-compliant, warrantied “battery backup system” from premium manufacturers.

A premium battery backup system here in the U.S. includes the imported battery cell pack (plus Trump’s import tariffs) plus power conversion circuitry (inverter/PCS), controls/monitoring, safety systems, switchgear/protection, etc. And then, of course, all of those components then need to be designed, assembled and packaged for distribution (if made in the US which is often the case with the battery systems that NATiVE Solar recommends). Finally, there’s the other hard-to-avoid system cost layers in the work that companies such as NATiVE need to complete in order to deliver a working system : engineering, permitting, construction, inspections, and installation labor. (These costs seem to be, unfortunately) moving a bit moving higher right now due to increased material and labor costs.

NREL’s storage cost work and ATB methodology explicitly notes that future (2026 and beyond) modest cost reductions are expected to come mostly from the battery pack, with much smaller reductions in balance-of-system and installation contributors. (NREL ATB: Commercial Battery Storage (method + cost drivers))

What homeowners actually pay (premium residential backup, installed): In the real market, installed pricing is far higher than $70–$108/kWh because it reflects the full delivered system. EnergySage’s marketplace data puts the median installed battery backup system cost at ~$1,037 per kWh of storage, with the range from ~$651/kWh (lower-cost options) up to ~ $1,510/kWh (premium options). (EnergySage: Home batteries (median $/kWh); EnergySage: $/kWh ranges by brand)

What businesses actually pay (commercial / institutional BESS, installed): Commercial pricing varies more because

each site and project has radically variable requirements, constraints, and scope. This said, commercial-scale battery backup systems tend to come with lower cost per KW/hour simply due to efficiencies of scale. It’s hard to pin down numbers here for you folks, but we see continued, modest pricing drops for commercial-scale BESS systems in 2026 as long as geopolitical and international trade (i.e. tariff) scenarios stay roughly where they are today.

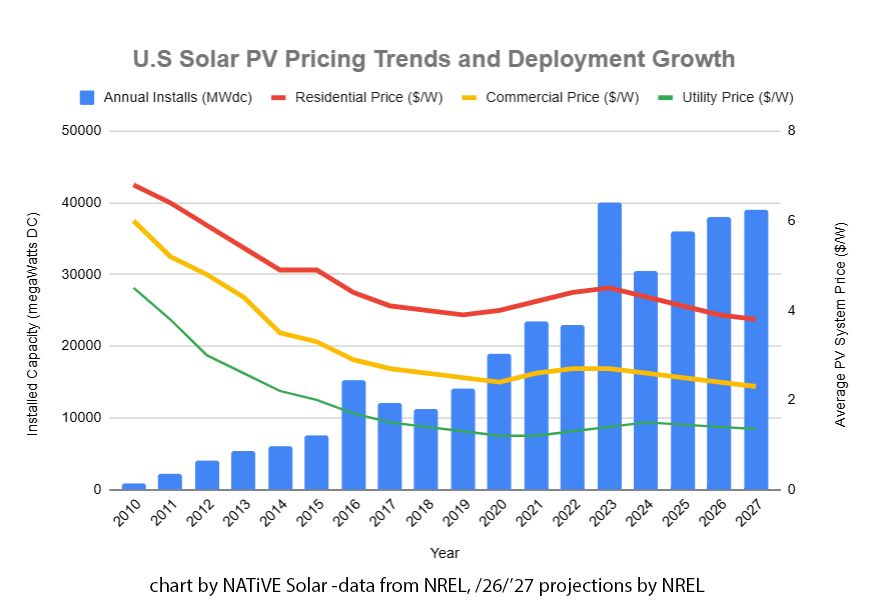

2.) PV module pricing in 2026: still historically low, but no longer falling — and in some cases slightly higher

On the solar panel side of things, compared to the last decade, PV module pricing in 2026 remains historically low. However, after the sharp declines of 2022–2024, panel prices are no longer in free-fall. In fact, some PV module categories are flat to modestly higher in 2026 compared to 2025, particularly for premium, U.S.-assembled and packaged modules like the ones we commonly specify for long-life residential and commercial systems.

This shift isn’t a “price spike” so much as a normalization. Years of global oversupply, driven largely by aggressive manufacturing expansion in China, pushed module prices below sustainable levels. As inventories cleared and manufacturers began re-asserting “margin discipline”, prices stabilized, and in some cases edged up slightly.

U.S. market reporting shows module pricing stabilizing around late-2025 levels, with selective increases tied to product class, origin, and policy exposure. PV Tech: U.S. solar module prices stabilize

Additional upward pressure is coming from several directions at once: rising input costs (notably silver), trade policy and tariff uncertainty, and continued reshoring / domestic-content requirements that affect which modules are eligible for certain projects.

These factors seem to be tending to put a something of a “floor” on pricing for high-quality panels. S&P Global: module pricing and policy impacts (also see : Nasdaq: silver cost pressure on PV manufacturing)

The practical takeaway here folks is that PV modules are no longer the primary cost lever in overall system pricing. In 2026, panels represent a smaller share of total installed system cost than they did even a few years ago -especially for commercial projects.

As a result, waiting for another dramatic drop in module pricing is unlikely to materially improve overall project economics.

3) Installed cost depends heavily on “soft costs,” not just panels and batteries

As I mentioned above, design, engineering, logistics, project management, and installation labor costs are up slightly from ’24/’25- so that figures in to the cost of a turn-key system. Even when hardware prices improve, the price you actually pay is shaped by labor, overhead, permitting, inspection, and interconnection -cost categories NREL explicitly includes in its bottom-up installed cost models: NREL installed-cost drivers

What this means for commercial & industrial (C&I) operators in Texas

For commercial solar in Texas, the 2026 cost conversation is less about panel or battery price headlines and much more about project risk, schedule certainty, interconnection realities, and value stacking (peak reduction, resilience, and operational continuity).

Some hardware costs are moving down modestly (notably batteries), others are flat to slightly higher than 2025 (notably PV modules), but those movements are rarely what makes or breaks a project.

In Texas, the projects that work best are designed around how the grid behaves, how (local utility power import/export) tariffs are structured, and how unpredictable load and peak events have become. NREL’s solar-plus-storage work on this topic is a good read if you want to go deeper, ya’ll : NREL: Solar + Storage Analysis

Why “value stacking” is now the baseline

- Electricity prices and volatility matter more than ever.

Texas commercial electricity prices have historically been lower than the U.S. average, but that advantage is narrowing as demand growth, congestion, and grid stress increase. (See sector-level pricing here: EIA: Texas electricity prices by sector) - Battery storage has moved into the mainstream.

ERCOT’s operational battery capacity reached 12,052 MW (rated power) and 19,442 MWh (energy capacity) by Q3 2025,

reflecting how common storage has become for managing peaks, mitigating risk, and supporting operational continuity:

Modo Energy: ERCOT Battery Buildout (Q3 2025) We expect local utilities (and VPPs!) to begin offering new/more profitable incentives for customers installing battery storage.

- Soft costs dominate real-world pricing differences.

Engineering and project management costs, interconnection pathways, and construction logistics (and labor!) often impact the system costs more than shaving a few cents off hardware. This is exactly what NREL’s installed-cost models show (i referenced this earlier in the article as well): NREL installed cost drivers

The practical takeaway for Texas C&I projects

In 2026, the strongest commercial solar (and solar-plus-storage) projects in Texas are not the ones chasing “perfect pricing.” They are the ones that:

- model systems against actual interval data and tariffs, not averages

- treat storage as a tool for peak management and resilience, not just arbitrage

- lock engineering and interconnection assumptions early

- optimize for buildability, schedule certainty, and long-term operating value

That approach is why many Texas organizations are moving forward now, even as some soft costs remain elevated. Utility rate pressure, demand growth, and grid stress are already showing up in bills and operations costs & budgets.

What this means for residential solar + battery in Texas

Residential solar in 2026 is still a strong value proposition -especially in Texas for large and custom residences- when it’s conceived and designed as an integrated smart home energy system, not a commodity purchase.

In practice, Texas homeowners see the best outcomes when solar + storage is engineered around:

(1) resilience goals (what loads matter, and for how long),

(2) real consumption patterns,

and (3) thoughtful system design and aesthetics.

This matters even more for many homeowners as Texas load growth and grid strain become part of everyday reality (see ERCOT’s long-term outlook: ERCOT Long-Term Load Forecast (PDF)

Leave A Comment