More Virtual Power Plants in Texas in ’26 -What That Means for Solar Property Owners

More Virtual Power Plants in Texas in ’26 -What That Means for Solar Property Owners

By Adam Glick, Solar Sherpa, NATiVE Solar

Here's a thing, dear reader: there is PLENTY of untapped energy that never gets accessed and distributed over the wires during extreme grid stress.

At the same time, Texas residences and businesses have installed massive amounts of grid-connected battery storage which now can be (but largely isn't yet) synchronized and discharged back to the grid to help smooth brown-outs and prevent blackout situations -and to maximize the "ROI" for these owned assets.

Up to now, this hasn't really been done due to a lack of coordination. But that coordination – in the form of Virtual Power Plant (VPP) programs- is now becoming an easy win-win-win option for electricity consumers all over the state. We've written about this here before.

How a VPP's come to market -Legislation meets Consumer Demand

For years, efforts to bring VPP offerings (ergo participation) in Texas moved slowly because wholesale market participation for aggregated "behind-the-meter" battery storage assets did not formally exist. There was no regulatory or business infrastructure to make it happen. ( *Industry Babble Definition here: Behind-the-meter (BTM) refers to energy equipment installed on a customer's side of the electric meter -like solar panels and batteries- that serves on-site loads first rather than supplying the broader grid.)

That regulatory landscape changed with ERCOT's ADER pilot in 2023.

"An Aggregate Distributed Energy Resource (ADER) is a collection of distribution-level premises aggregated to respond to ERCOT dispatch instructions."

— ERCOT ADER Pilot Overview (ercot.com)"Small energy resources found in homes and businesses across Texas have incredible potential to continue improving grid reliability and resiliency by selling the excess power they generate to the ERCOT system. It's a win-win for Texas. Home and business owners get paid for power they supply and consumers in ERCOT get more reliability."

— PUCT Commissioner Will McAdams

The folks that actually run the grid -the electric coops and utility companies mostly jumped on-board:

"We're actually empowering the member so they can participate in the wholesale market directly."

— Bill Hetherington, CEO, Bandera Electric Cooperative

(Cooperative.com, 2024)

Private 3rd-parties jumped in over the course of 24′-25′ to partner with the various electric utilities and providers. Now in 2026, there is (finally, after a slow start) an explosion of VPP options for residential batteries and commercial battery energy storage (BESS) systems allowing energy storage to be collectively synchronized and discharged over the grid as needed.

Basically, battery system owners get paid higher returns to allow VPP programs to discharge some of their stored battery energy into the grid when it's needed most. The idea is wrapped up in what is known as: Virtual Power Plants – aka "VPP"s.

Major Energy Companies Are Committing New Programs and Gigawatts in Combined, Otherwise Untapped Power

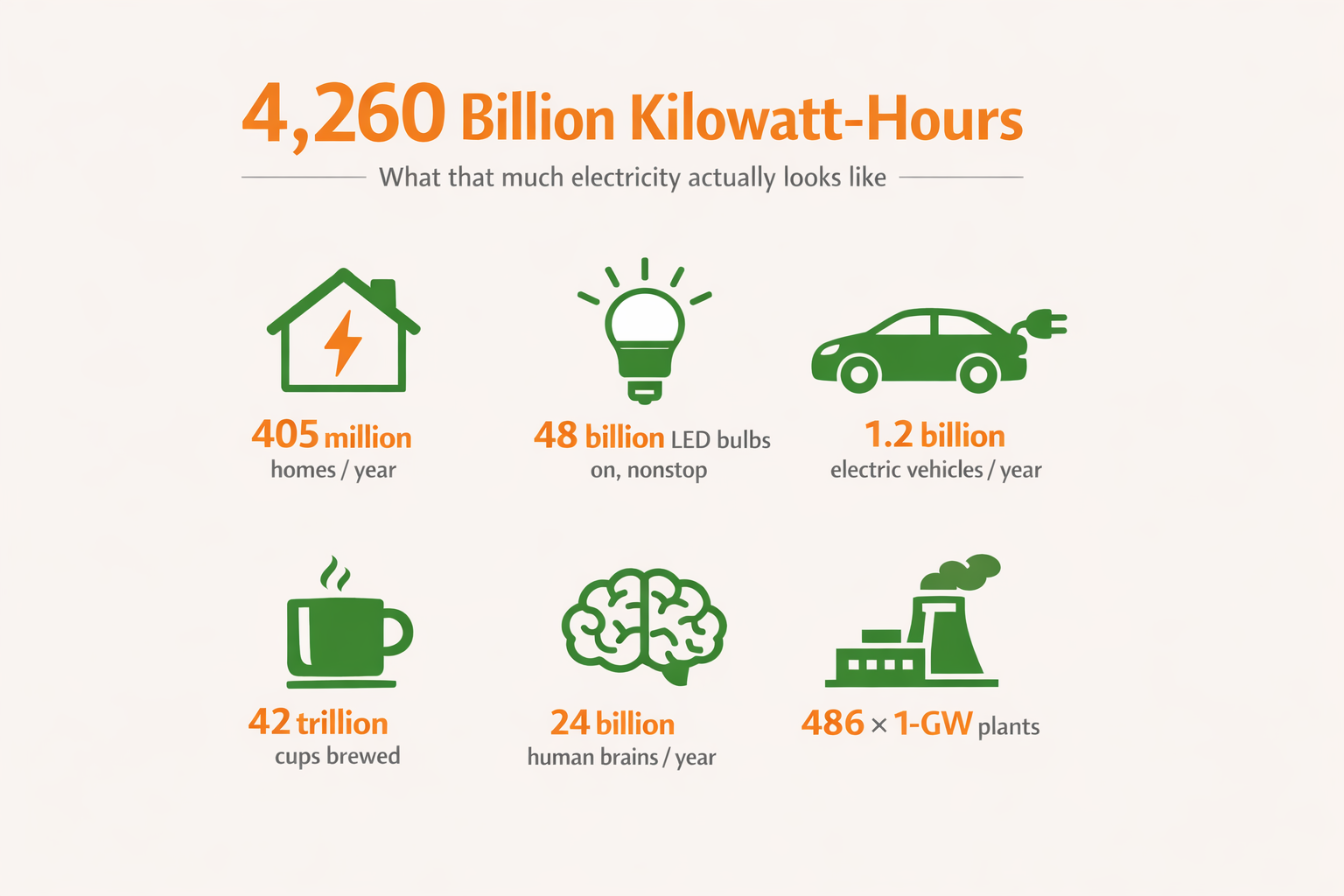

A new VPP initiative announced in December of '25 is planned to add 1 Gigawatt of otherwise untapped battery capacity to the grid -the equivalent of 200,000 homes.

"This partnership is a major step in achieving our goal of creating a 1 GW virtual power plant by 2035″…"We're unlocking a new source of dispatchable, flexible energy…"

— Brad Bentley, EVP, NRG Consumer

NRG's partner in this VPP offering –SunRun- is a huge national solar provider who already has over 100,000 residential solar customers across the country signed up as VPP participants. Their announcement to offer VPP participation to a large swath of Texas consumers seems like a solid win.

That's just one example. There are several other either being built -or already up-and-running -some of which we've covered here in the past including :

SonnenConnect Texas (SOLRITE & sonnen VPP PPA) – A virtual power plant power purchase agreement offering solar + battery with no upfront cost and grid support.

🔗 https://www.solriteenergy.com/texas

🔗 https://www.sonnenusa.com/virtual-power-plant/sonnenconnect-texasOctopus Energy Intelligent VPP (Texas) – Join the Octopus VPP program and receive bill credits for enrolling battery storage (typically Enphase systems) while retaining backup capability.

🔗 https://nativesolar.com/octopus-virtual-power-plant-texas/Rhythm Energy VPP (coming 2026) – A residential VPP offering expected to launch in 2026 for home battery owners across Texas.

🔗 https://www.gotrhythm.com/blog/virtual-power-plan-texas-residential-battery-programAustin Energy VPP Pilot – Austin Energy is preparing programs to integrate customer battery systems into VPPs with incentives and grid services (expected rollout starting around 2025–2027).

🔗 (General info, Austin Energy related program via EticaAG article) https://eticaag.com/texas-energy-storage-incentives-opportunities/- Tesla Virtual Power Plant (Tesla Electric statewide) – The general Tesla Electric VPP offering in Texas for Powerwall owners.

🔗 https://www.tesla.com/support/energy/virtual-power-plant/tesla-electric

Residential: Why Homeowners Are Re-Engaging

Over the past few years, Texas solar "buy-back" (solar energy export) rates have weakened. In most areas, the credit you receive for exporting excess solar power no longer matches what you pay to consume electricity. In plain terms: utilities often buy low and sell high. As Regan George, CEO of Solrite Energy, put it:

"Homeowners are looking for a new buyback program… but they're not finding it in the market."

— Regan George

(Latitude Media, Feb. 11, 2026)

With all the new VPP options popping up around the state, residential batteries aren't just sitting on the wall for outage backup and peak usage triage -they can potentially be coordinated and dispatched as part of a larger grid resource.

Meanwhile, Texas grid-scale battery capacity has grown from a few hundred megawatts in 2020 to roughly 14 gigawatts by 2025 (Texas Comptroller, 2024; Modo Energy, 2025), signaling that storage is now a serious part of the state's energy strategy.

For homeowners, the way battery backup is perceived may be shifting from merely backup devices for personal use into one that sees batteries as multi-purpose energy assets :) which layer resilience, bill management, market participation, and grid stabilization into one system. Neato.

Commercial & Industrial: Where the Real Capacity Lives

Residential VPPs scale through participation. Commercial VPPs scale through power. And there are brand new options spinning up around the state for commercial property owners with solar+battery installed.

As Nick Chaset of Octopus Energy told The Texas Tribune:

"We want to show that you don't need as many… big backup power plants, because these distributed energy resources are reliable…"

— Nick Chaset, EVP North America, Octopus Energy (Commercial VPP Division)

(The Texas Tribune, Feb. 18, 2025)

For commercial operators, "behind-the-meter" storage is already a financial tool. It reduces peak demand charges, improves resilience, and limits exposure to volatility. That's good stuff. And now it gets better…

Aggregation programs and VPP participation may add upside, but the primary case is still demand management and operational control. All this said, in practical terms, a single 500 kW commercial battery can provide more dispatchable flexibility during grid stress than dozens of residential systems combined. I think many businesses will probably look favorably at the profit/loss side of the equation, as well. Yes, It checks ESG pillars -and the bean-counters like it. Win-Win.

Notes on Commercial VPP Participation

ADER is the primary vehicle for true commercial VPPs -it allows businesses with batteries, flexible loads, or behind-the-meter systems to aggregate with others in ERCOT's wholesale market.

Most named programs (Tesla, Sunrun/NRG, sonnen/SOLRITE) are marketed toward residential participation but can also enroll commercial battery assets (e.g., Powerwalls on small businesses) if they meet eligibility and aggregation criteria.

Utility or co-op pilots like Base/GVEC and future Austin Energy offerings may provide additional C&I-friendly enrollment paths without the third-party retail REP requirement (they essentially (and legally) ARE your retail electric provider as well !)

Leave A Comment