The Window for Claiming the 30% Solar Tax Credit is Closing

The Window for Claiming the 30% Solar Tax Credit is Closing

By Adam Glick, Solar Sherpa, NATiVE Solar

The Clock Is Ticking

The current 30% tax credit was part of the 2022 Inflation Reduction Act — a much-needed boost for clean energy adoption. But that’s all going away Jan 1st now that the “Big Beautiful Bill” has passed Congress.

No extensions. No do-overs.

What Does That Mean for You?

If you’re planning to install solar panels on your home and you want the full 30% federal tax credit, your system needs to be installed and operational before the deadline.

And given permitting timelines, utility approvals, equipment demand, and general construction reality… that deadline is effectively NOW. If you wait another couple of weeks, you’re going to be part of the last-minute scramble — where any quality Texas solar installation firms are on their way to being booked solid through the end of the year. That would suck for those who had planned on the 30% ITC.

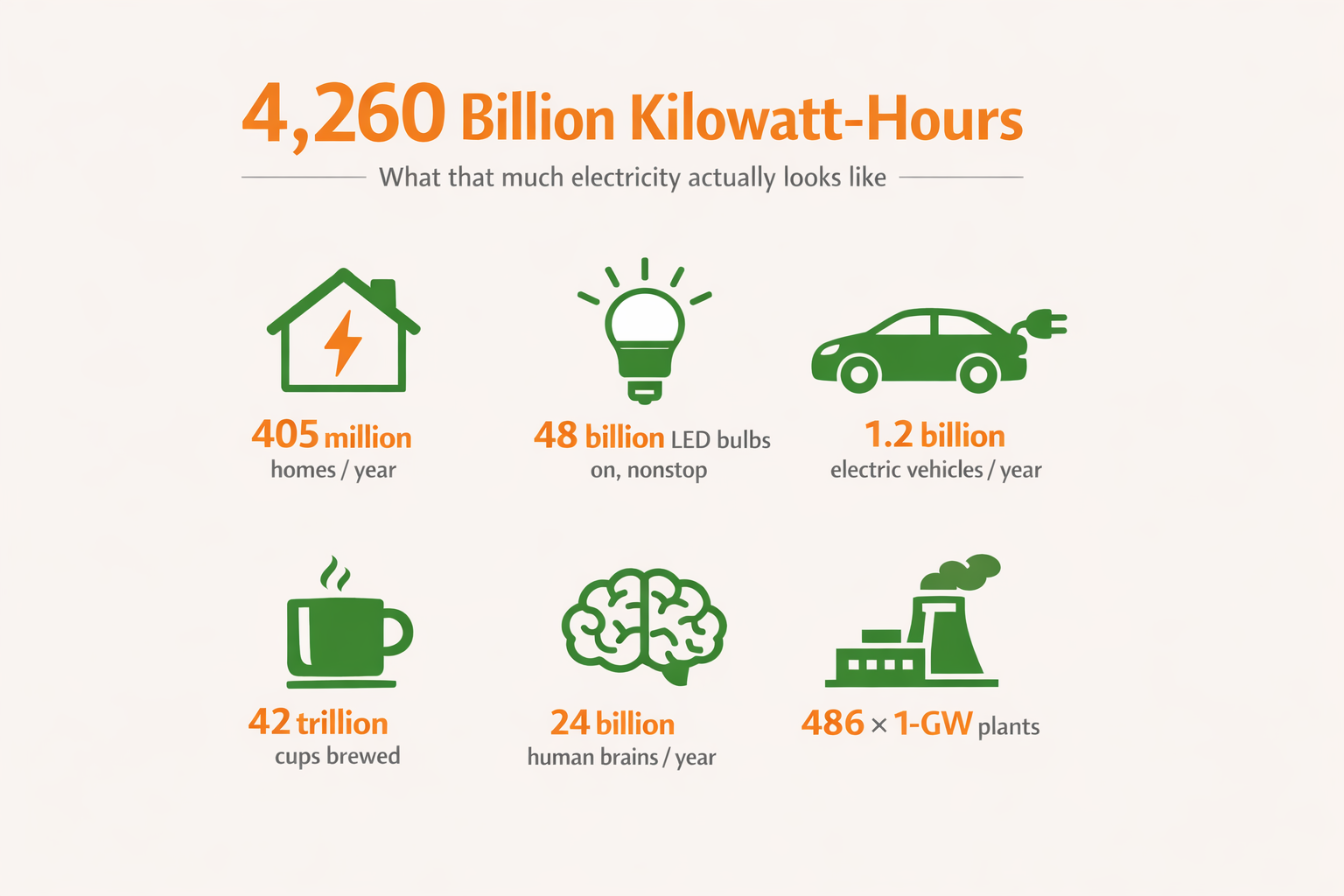

Why the 30% Credit Matters

That 30% incentive often translates to $6,000–$75,000 in tax savings for our high-end homeowner client. It’s what helps make solar not just good for the planet, but also a smart financial move.

Without it, the economics change. Solar will still be worthwhile — especially here in Texas with our wild energy prices and bountiful sun— but the payback period gets a bit longer. And if you’re adding battery backup? The value of the credit is even more significant.

We’re Not Here to Scare You (But We’re Also Not Sugarcoating It)

This isn’t a scare tactic. It’s just a fact.

If you’re more than “solar-curious”, now’s the time to move from curiosity to commitment. If you’re building a new home, your solar design should already be in motion.

What You Can Do Right Now

- Schedule a consultation and/or site visit — so we can confirm what’s possible (and smart).

- Get a custom quote — not a cookie-cutter estimate. Every property and family is different – with different requirements and expectations.

- Talk to your CPA — to confirm tax eligibility and timing.

- Make the call— secure your spot before everyone else floods the system.

At NATiVE Solar, we’ve helped hundreds of Texans claim their solar tax credit, lock in long-term savings, and take control of their energy self-sufficiency. But we can’t backdate your install. Once that window closes, it’s closed.

Don’t wait this Congress to change its mind. (They won’t.) The 30% solar tax credit is still on the table — but not for long.

Let’s make it count.

📞 Get Started or give us a call: 855-234-3131

Leave A Comment