Texas Solar: Strong Fundamentals Beyond the OBBB

Texas Solar: Strong Fundamentals Beyond the OBBB

By Adam Glick, Solar Sherpa, NATiVE Solar

Texas solar fundamentals beyond OBBB are what matter now. When the One Big Beautiful Bill (OBBB) became law in July, it reshaped federal clean-energy incentives. Headlines focused on deadlines and phase-outs. But here in Texas, the real story isn’t about a ticking clock. It’s about fundamentals that make solar too strong to slow down: rising electricity costs, record power demand, and the resilience Texans want in the face of grid instability.

Residential Solar: Independence and Rising Costs

Texans know energy costs aren’t going down. Modeling indicates household energy bills could rise about $220/year by 2030 and $480/year by 2035, with retail electricity rates up 23–54% as clean-energy buildout slows (Energy Innovation -Texas impacts; Energy Capital HTX coverage).

That’s why many Texans are looking at solar+battery not just as an investment, but as insurance. Storage-backed systems keep the lights on during storms and ERCOT volatility—a reality made plain by the 2021 grid crisis and repeated summer stress events, where batteries helped carry the evening peaks (Texas Tribune – batteries during heat; Dallas Fed – solar & storage aided reliability).

For many of our clients, it’s less (or maybe as much) about chasing a tax credit and more about locking in control, predictability, and resilience. Bottom line: Texas solar fundamentals beyond OBBB are pushing homeowners toward solar + storage for control, predictability, and resilience.

Commercial Solar a& Battery Energy Storage: Economics and Scale

Texas businesses are staring down volatile wholesale markets and rising large-load demand. Grid-scale and solar + storage remains the lowest-cost new-build option, making it a go-to for flattening long-run energy costs (Lazard LCOE+ 2025).

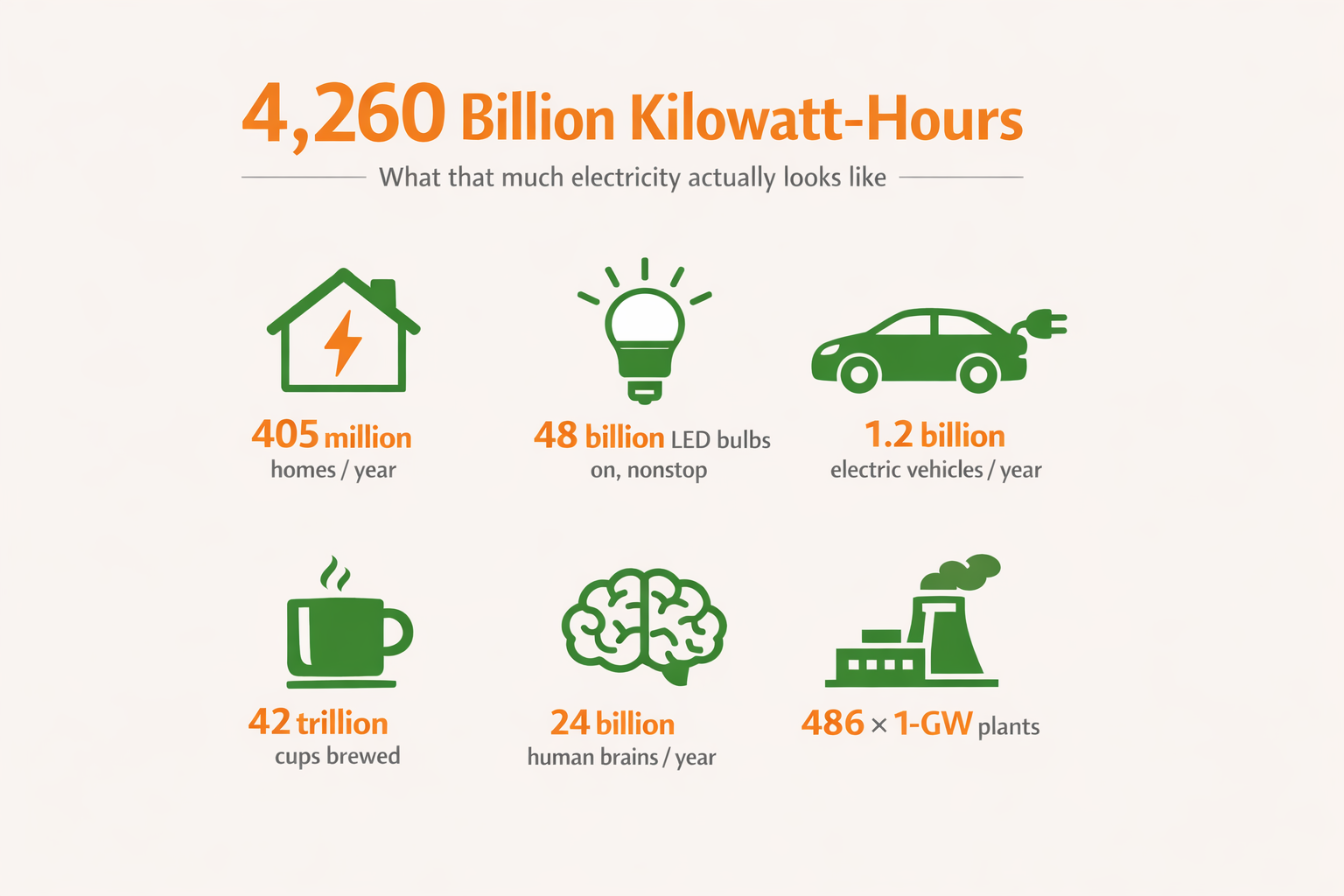

Reframed Reality Check (Still Strength): Even with OBBB cutting projections from over 100 GW to about 27 GW over the next decade, Texas remains on track to add substantial new capacity—enough to power millions of homes—because the underlying economics are still compelling (Houston Chronicle coverage; Advanced Energy United summary).

Manufacturing Momentum

Manufacturers see the opportunity, too. T1 Energy has advanced an $850M, 5 GW solar-cell plant in Rockdale (GlobeNewswire/Nasdaq release; T1 investor page), with local reports confirming scale and jobs (KXXV). These moves show confidence that demand is here to stay.

Texas Solar Fundamentals That Don’t Expire

- Low-Cost New Power: Utility-scale solar remains among the most cost-effective new generation resources (Lazard LCOE+ overview).

- Surging Demand (The Runway): ERCOT’s 2025 long-term materials show officer-attested large-load growth (especially data centers) driving tens of gigawatts of new demand this decade—ensuring solar must keep scaling because few resources can be built as quickly and cost-effectively (ERCOT long-term forecast report; ERCOT RPG slide deck).

- Reliability Value: Pairing solar with storage supports the grid during peaks and extreme events; Texas already leaned on batteries during summer stress (Texas Tribune; Texas Comptroller – batteries reduced prices).

- Top-Tier Resource & Scale: Texas has excellent solar resource (NREL solar resource maps) and ranks #2 nationally for installed capacity (SEIA Texas; SEIA Q2-2025 data sheet).

ERCOT Demand Makes Solar Inevitable

ERCOT’s large-load growth -from growing population to data centers- means Texas needs immediately dispatchable, scalable, and cost-competitive power generation. That’s precisely where solar (and storage) excels. In other words, OBBB may slow growth, but surging demand keeps Texas solar on growth trajectory.

Our Conclusions –

OBBB may have shortened timelines, but Texas solar isn’t built on policy alone.

For homeowners, higher bills and grid risks make solar + storage a no-brainer.

For businesses, long-term operational savings and corporate sustainability goals keep the momentum strong.

For Texas, growth in population and demand means solar is here to stay—no matter how incentives shift.

**Oh, and our team is hiring for nearly all positions as we position for growth.

At NATiVE Solar, we’re guiding Texans through today’s urgency while building projects that deliver decades of value. The incentives may change, but the fundamentals are permanent. And the sun isn’t going anywhere.

Leave A Comment