A Practical Checklist for Texas Commercial & Industrial Property Owners Considering Solar or Storage

A Practical Checklist for Texas Commercial & Industrial Property Owners Considering Solar or Storage

By Adam Glick, Solar Sherpa, NATiVE Solar

If you’re evaluating Texas commercial solar and battery storage as a commercial property owner or landowner here in Texas, there are a few questions that matter early—well before RFPs or proposals start flying around.

Here we wanted to give a quick heads-up and some high-level pointers around the short- and long-term tax implications of commercial solar and battery storage projects in Texas. These are questions you’ll likely want to raise with your principals, board, and finance team before going too far down the solar path. By the time we (here at NATiVE) get involved, most of these items have usually already been evaluated -but not always. Looking at tax and regulatory implications early is one of the first avenues of investigation that should be traveled early.

Property & tax basics for Texas commercial solar and battery storage

Is the system likely to be treated as a taxable improvement by the local appraisal district?

Are local abatements (Texas Tax Code Chapter 312) available in this jurisdiction, and has the county or city used them recently?

https://comptroller.texas.gov/economy/local/ch312/

If an abatement is possible, what’s the realistic timeline and approval process?

Ownership structure for commercial solar projects in Texas

Will the system be owned by you, or by a third party (PPA / energy services agreement)?

How does that ownership choice affect:

Property tax treatment

Control over the asset

End-of-term options (buyout, removal, extension)?

Ownership structure plays a meaningful role in how Texas commercial solar and battery storage systems are designed, built, taxed and operated over time. Your controller or tax attorneys should dive into this early!!

Interconnection reality check

What utility territory are you in, and what’s their interconnection posture right now?

Is the project size likely to trigger:

Detailed studies

System upgrades

Longer review timelines?

ERCOT interconnection guidance (process overview):

https://www.ercot.com/services/rq

Resource Interconnection Handbook (procedural):

https://www.ercot.com/services/rq/integration

Interconnection is often the quiet constraint that determines whether a Texas commercial solar or battery storage project stays theoretical or becomes real once feasibility and economics are fully modeled.

Battery storage–specific questions (Texas BESS projects)

If batteries are involved:

Is the system behind the meter, grid-connected, or hybrid?

Does the agreement address decommissioning and financial assurance, as now required under Texas Utilities Code Chapter 303?

https://statutes.capitol.texas.gov/Docs/UT/htm/UT.303.htm

Who is responsible at end of life, and how is that obligation secured?

Legal background (plain-English analysis):

https://www.bakerbotts.com/thought-leadership/publications/2025/july/texas-adopts-new-decommissioning-law-for-battery-energy-storage-systems

Time horizon alignment for Texas commercial solar and storage

Is the project being evaluated on a 5–7 year financial lens, or a 20–30 year operational lens?

Does that match how long you expect to own or operate the facility?

Are assumptions about utility rates, demand charges, and operating costs realistically modeled and clearly stated?

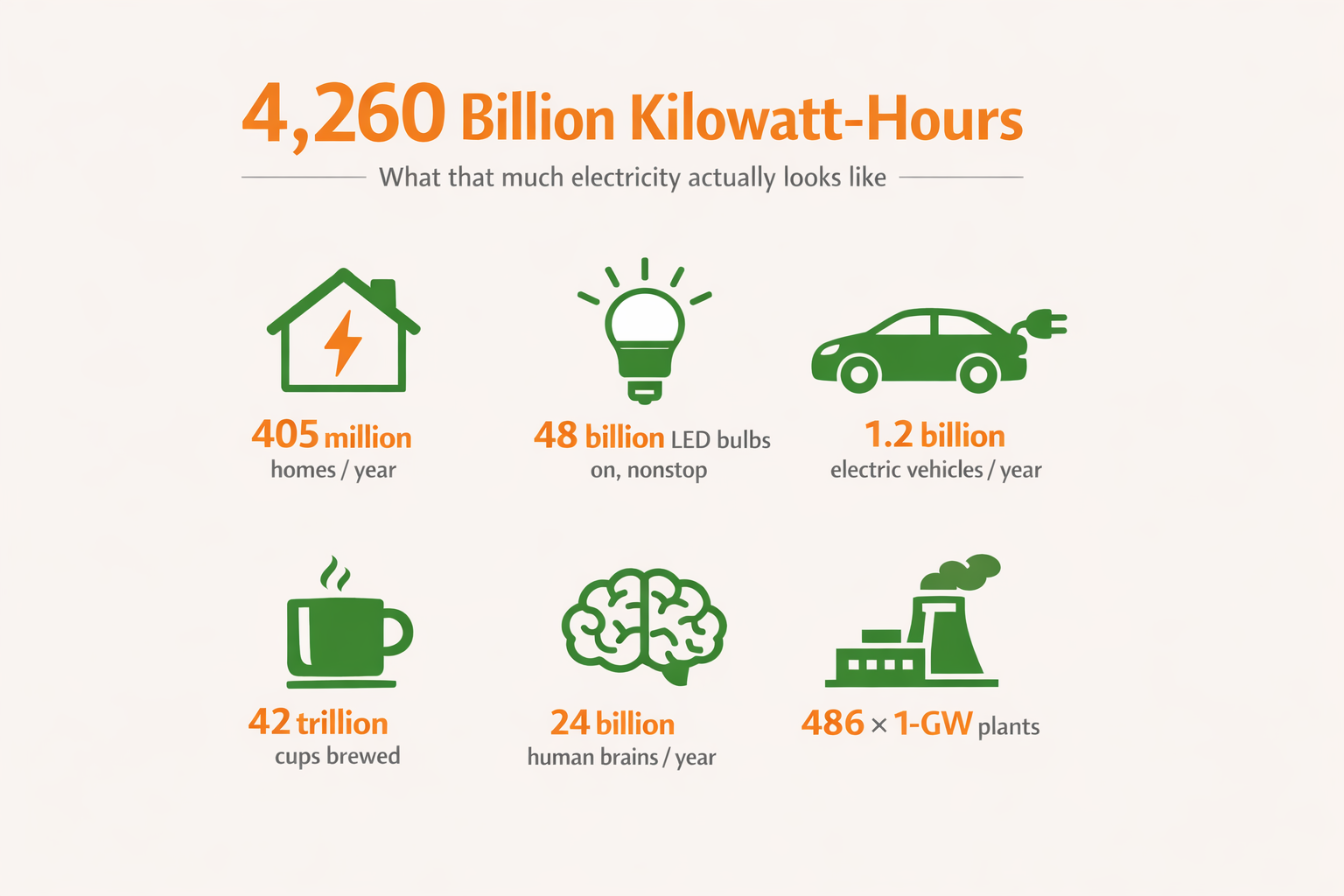

The recent economic impact report by Dr. Joshua Rhodes (UT-Austin) assumes 30-year lives for solar and wind and 15 years for battery energy storage—an important reality check when reviewing Texas commercial solar and battery storage proposals:

https://kbhenergycenter.utexas.edu/media/the-economic-impact-of-renewable-energy-and-energy-storage-investments-across-texas/

Digging in to the short, medium, and long-term economics is crucial among first steps in assessing feasibility.

Incentives and tax credits for commercial solar in Texas

Are state or local incentives statutory and available, or merely “possible”?

Are they time-limited, compliance-driven, or discretionary?

Does the project still make sense if incentives change or expire?

Texas incentive programs to be aware of:

Chapter 312 abatements (local):

https://comptroller.texas.gov/economy/local/ch312/JETI (school district M&O limitation):

https://comptroller.texas.gov/economy/local/jeti/

*****The 30% federal solar tax credit still matters here (with a July 4, 2026 cutoff), but it mostly influences financing mechanics—not local tax treatment for Texas commercial solar and battery storage projects.

So What’s the Takeaway?

This tax stuff comes up often for discussion as site design begins. The implications matter. Understanding these mechanics early makes it much easier to decide whether a project belongs on your capital plan or should stay on the whiteboard.

Get in touch if you’d like to discuss how NATiVE’s commercial smart energy team helps Texas businesses navigate commercial solar and battery storage decisions with fewer surprises.

Leave A Comment