Austin Energy Warns of ‘Tremendous Strain’ on the Grid as Data Center Growth Surges

Austin Energy Warns of ‘Tremendous Strain’ on the Grid as Data Center Growth Surges

By Adam Glick, Solar Sherpa, NATiVE Solar

Well, folks, Austin Energy is publicly warning of “tremendous strain” on the local grid as new data centers seek power.

According to Kerrica Laake, Austin Chief Information Officer: “Utilities in Central Texas have been able to keep up with traditional high growth for decades; however, AI is challenging the definition of high growth… the speed in which AI is trying to be deployed creates tremendous strain.”

Community Impact

For some time, the writing has been on the wall about the coming challenges that hyperscaled datacenters pose to our electrical grid. And the threat just got named -along with a 10-year plan to address the situation.

So what’s happening?

We’ve seen a slow and steady rise in the number, size and power consumption demands of data centers over the past few years. Historically, a “large” data center might add about 30 megawatts (MW) of load, roughly powering ~6,000 homes. These facilities housed the computers, storage and data switching required for serving internet sites, online apps for banking, travel, and various other data-based services.

But the demands of AI are different. The computer hardware required to process AI-based tasks introduces exponential power consumption. Now, data centers designed to accelerate AI workloads are “routinely” requesting 300 MW and more, and most of these proposals are on timelines utilities never anticipated when our power grids were designed and built over the past decades.

AE’s VP, David Tomczyszyn said: “The size of these loads and how fast they’re looking to come on… it’s tremendous.”

Community Impact

The city is couching this newly proposed 10-year, $740 million plan largely as a “modernization” effort, with carveouts for things like “vegetation management” and “weatherization”. But let’s see through the PR –this is mostly about preparing the grid for the expected additional strain from AI datacenters.

And importantly, this grid hardening/expansion is probably not going to be unusual in how it gets paid for. Under long-standing utility finance models, capital investments in transmission, distribution, and generation are typically recovered through customer rates over time. Apparently, this isn’t likely to change much.

How Much Power Modern Data Centers Use

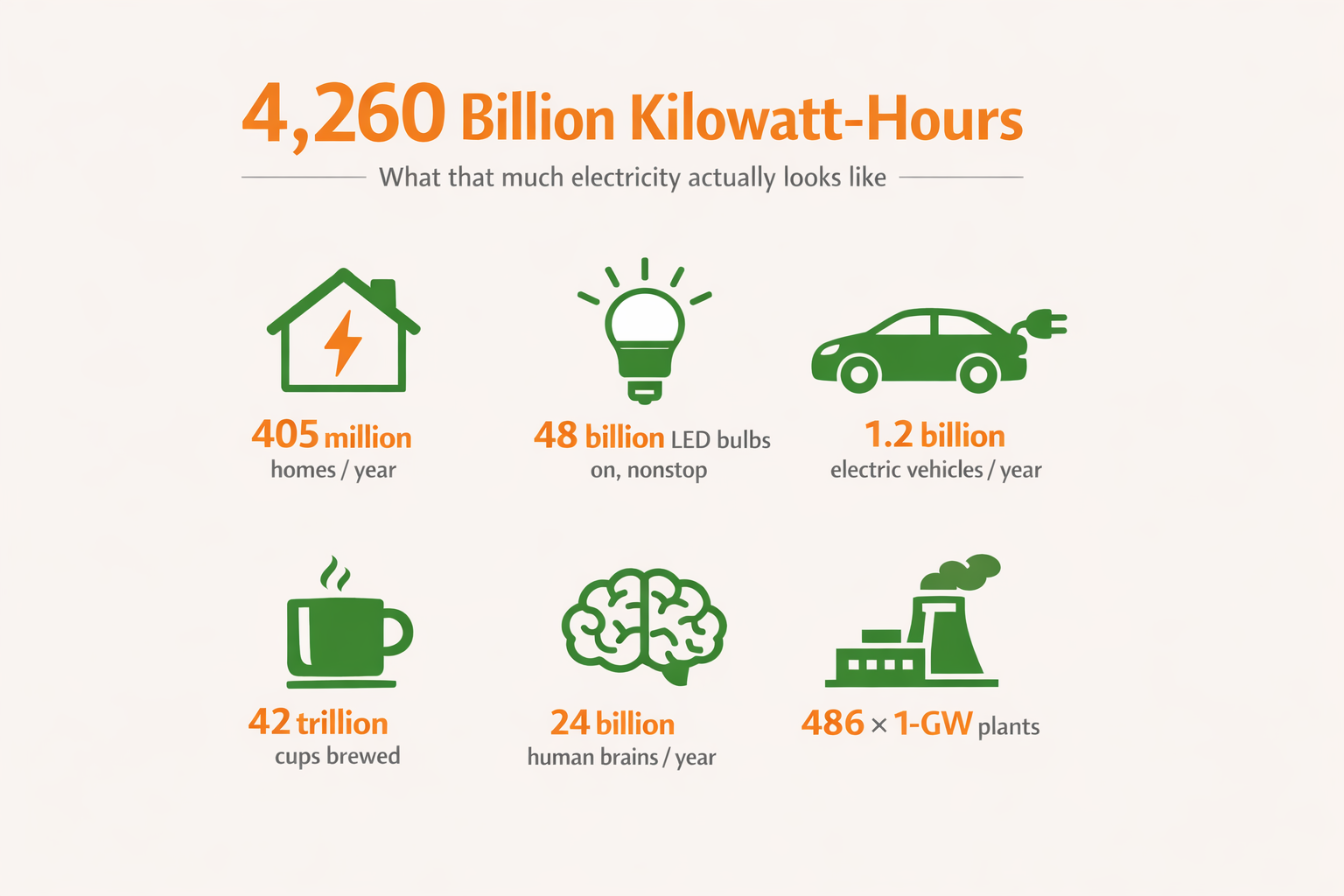

After years of moderate but manageable rises in energy consumption, data center electricity demand has recently been climbing sharply. U.S. data centers consumed about 176 terawatt-hours (TWh) in 2023 — roughly 4.4% of total U.S. electricity use. That’s up from 58 TWh in 2014 and is expected to reach 325–580 TWh by 2028, which could be 6.7%–12% of U.S. electricity consumption under current trends.

Berkeley Lab News Center

The new datacenters under construction — or in the planning stages — have power requirements that often equal city-scale demand. The largest of these have designs requiring over 10 gigawatts (10,000 MW). That’s enough energy to run about 8.6 million homes. Yeah, it’s nuts. *I’ve written about the enormous new 11 Gigawatt “Hypergrid” (aka “Project Matador”) data center/power generation complex (expected to cost over $300 Billion to complete) which has already broken ground near Amarillo – despite recent funding setbacks.

While some of these planned mega-datacenter complexes intend to generate some or all of their own electricity (like the one above), that won’t be the case for most of the new AI datacenters being planned. They are going to rely on the same electrical grid and supply that we do. And even when data centers pay for their immediate interconnection infrastructure, broader transmission and generation upgrades are often classified as “system-wide” improvements.

Grid Strain!

Our grid wasn’t built for all this. Texas’s electrical infrastructure was designed and hardened over decades under assumptions of slow, predictable demand growth. Nobody saw AI coming -and it’s clear that some things are going to have to change.

Electrical transmission and distribution buildouts take years to plan and complete. Meanwhile, many data center developers are asking for capacity on timelines measured in months.

ERCOT, the folks who plan, manage and run most of the Texas grid, have said are tracking an unprecedented backlog of large-load interconnection requests driven in part by AI and cloud facilities. ERCOT officials have publicly acknowledged that this growth will require significant transmission investment -and that it raises difficult questions about who ultimately pays. We already touched on this…

That puts planners in a tough position: serve new customers quickly, or risk grid instability for everyone else.

Implications for Existing Customers

Building out new grid and power generation infrastructure is costly. Very costly. Austin Energy’s newly announced plan is expected to cost roughly three-quarters of a billion dollars ($735 million).

History suggests that when infrastructure upgrades are deemed necessary for overall reliability, those costs are typically recovered through utility rates. Consumer advocates and analysts have repeatedly warned that without explicit safeguards, residential and small commercial customers can end up subsidizing infrastructure built primarily to support large new loads.

A Union of Concerned Scientists analysis found that when upgrades are treated as system-wide, the costs are frequently socialized across all ratepayers. Yeah, that sounds about right… ;/ And our friends at Utility Dive documented a similar pattern in the East coast region, where more than $4.4 billion in transmission upgrade costs tied to data center growth were ultimately borne by ratepayers under existing cost-allocation rules.

This points us to the notion that the planned investment in our grid infrastructure is likely to be recovered -at least in part- through rate increases on existing customers. What a surprise. 🙂

For commercial utility ratepayers, this may show up as new or revised tariffs, higher demand charges, and increased expectations for load mitigation such as on-site generation and battery energy storage.

Residential customers are more likely to see impacts in the form of higher monthly fees or increased per-kilowatt-hour charges. National reporting has already flagged rising concerns that unchecked data center growth could contribute to higher electric bills if cost allocation rules don’t evolve.

Political Wrangling Is Underway

I recently penned several blog entries here on The Feed referencing Texas Senate Bill 6, passed earlier this year, which, among other things, targets large energy users connecting at 75 MW and above. The bill reflects growing concern among Texas lawmakers that current utility frameworks were never designed for city-scale loads arriving all at once.

Even with SB 6, however, debates remain over which costs can legally be assigned directly to data centers versus those classified as system-wide investments -the latter of which traditionally land on the broader rate base.

Other states are doing the same thing. And federal agencies and the folks in the U.S. Congress are also taking note and beginning to pass legislation aimed at ensuring proper federal oversight of our nation’s power grids and datacenters’ access to limited power supplies. However, with the current climate of poisoned partisan politics in Washington, we just hope they see the bigger picture here and are able to take effective and quick action where appropriate. (sighs)

Where Solar and Storage Fit

Distributed solar adds daytime power capacity, while batteries help shift and firm load when heavy demand persists beyond peak hours.

Solar and storage increasingly function as grid infrastructure, not just clean energy upgrades. They offer utilities a way to add flexible capacity faster than traditional generation or transmission projects.

This aligns with resilience initiatives already underway in many jurisdictions as part of longer-term grid planning.

Between renewables (including solar, wind power and hydro), energy storage, new safer Nuclear, and “clean” coal, the US *MAY* be able to deliver enough power generation.

*This assumes the additional investment is also made in updating all the transmission lines across regional power grids. After all, generating more power won’t do any good if there isn’t enough capacity in the high-tension power lines to get the electricity where it’s needed…

The Bigger Picture

Data centers represent a new load class, not incremental growth. It’s a shock to the system.

Austin Energy’s warning reflects a broader trend: the digital economy is reshaping physical energy infrastructure faster than our planning models were built to handle.

Policymakers, utilities, and customers -commercial and residential alike -are now grappling with questions of cost allocation, reliability, and long-term strategy.

The grid isn’t failing. (much. yet.) But it is being asked to do something fundamentally new. And only time will tell if cities, states and the federal gov can collectively solve the energy challenges posed by massive datacenter growth.

Nuclear power is neither clean nor safe. Humans do not have the wisdom to safely use concentrated nuclear power. So long as we do not have peace on earth, we lack the capacity to safely generate and use nuclear energy, and safely dispose of nuclear forever waste. The push for more energy consuming industries, like AI, data centers and water polluting industries like fracking (creating pressure for desalination) are designed to create an extreme demand for energy and an excuse for nuclear energy proliferation. Further all nuclear energy can be weaponized. The pursuit of nuclear energy proliferation is insanity.

Thanks for sharing your thoughts, Kim. There are many issues to track. It’s hard to know what is driving what… But we can follow the money… :/