Getting Solar Power on a Loan is the Safest Investment in Economic Downturn

Yes, I said loan. How many loans save you money the first year? Some business loans do that, but really there is no option for a homeowner other than solar panels.

Think about this simple concept:

Take your current average yearly budget for energy bills and divide by 12 months. If solar payments are less than that, you are saving money right away. All you need is a guarantee that the Sun shines and the power bills keep coming, it is as certain as death and taxes.

Current situation

As I type this, COVID-19 or Corona virus has materialized into a full-blown pandemic and soon we’ll feel the full force of its impact on the global economy. People will sell stocks, liquidate investments, and hunker down their finances as scarcity and fears rear their heads across our country.

What can the average household do in recessions but survive?

There won’t be great investment opportunities that carry little to no risk until stocks bottom out, if you know where and when that is, and very few people get that right.

My argument is hardly an argument at all, just simple facts.

If you plan on paying a power company to keep your electricity, why not have greater control over your power source? You own the power. Yes, on a loan, but a loan is designed to be paid off. The power company is renting power to you forever; or in perpetuity.

All you need to know is that the Sun rises and you pay the power company less. And in the event of a disruption in the power grid, you have a potential sustainable power source (with some storage options of course). The key is resilience.

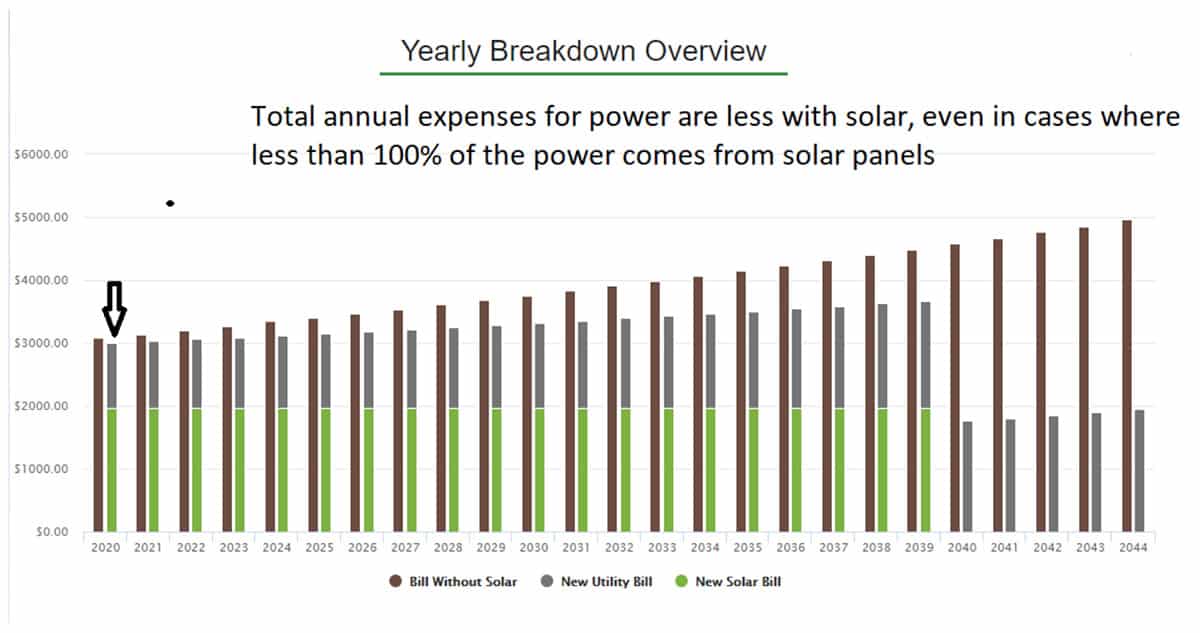

Even if half the power for a home is generated by solar, causing a loan payment and a power bill payment, the annual savings begin right away. See the graph for a real example:

Over the years, energy costs may rise significantly, or they may stay nearly flat, but a loan is a protection from inflation. It doesn’t go up.

Common objections

Loans

I already know you are thinking a 20 year loan is too long, that you may move in that time. This is met by two answers.

- The loans are all transferrable

- There is no early payoff penalty. If the new homeowner decided to add on the balance to the mortgage the cash flow comparison gets even better because the monthly cost of the money going to pay for power goes down even more.

Cost of maintenance and roof replacements

Solar is often argued by people who don’t know much about the equipment that it is expensive to maintain. This is not the case. Warranties last 25 years on the panels and the inverters. If the installer charges $200 once or twice to come out and replace a warranty part then there is still a savings over not having solar.

If the roof needs to be replaced in the timeframe of 25 years insurance will cover the cost of removing and replacing the panels.

Hail

Current panels will not be damaged by normal hail. They are tested with 1” ice or metal bearings at 55+mph and in some cases much higher. 55mph is the industry standard minimum for a tier1 panel. If some act of nature does destroy the panels, again, home insurance covers.

Requirements for solar ownership

- Own the home

- Use power in the home

- Decent credit of 650 and a debt to income ratio of 45% or better

Final correlation

If you want an easy way to consider these concepts in a different way, just realize it is a necessary expense in life to pay for power. Just like housing, clothing, food, and water.

If I offered a 20 year loan on your monthly grocery bill, and in time told you that you had paid off that loan but please continue to receive the same groceries every month anyway, you’d do it. No brainer, right?

You already own your home, and payments will end one day if they have not already. So why do you rent your power?

Leave A Comment